This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

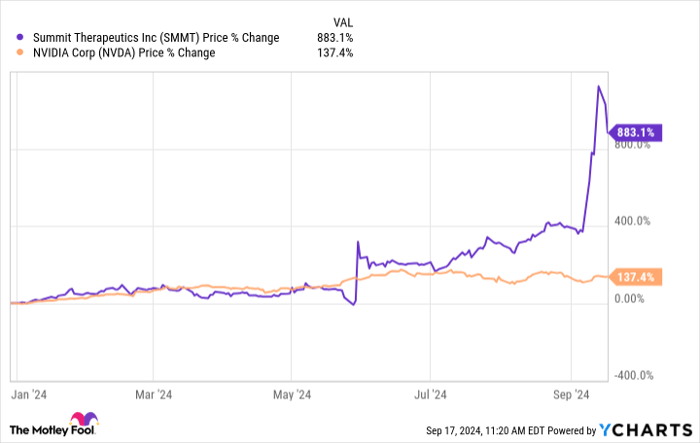

Few companies have attracted more attention this year than Nvidia. The chipmaker is on a roll thanks to the rapid rise of artificial intelligence, and its revenue, earnings, and stock price continue to grow incredibly fast. Nvidia's shares are up by 137% this year.

Some companies have performed even better, including one many investors may never have heard about: Summit Therapeutics (NASDAQ: SMMT). The biotech's performance this year makes Nvidia's look mediocre: Summit's shares are up by almost 900% year to date.

What exactly is driving this performance? Are Summit Therapeutics' shares still attractive? Let's find out.

Summit is taking on a giant

Summit focuses on developing cancer medicines. As is usually the case when a drugmaker rises this fast, it owes its recent run of form to excellent clinical progress related to its leading pipeline candidate, ivonescimab.

Originally developed by a China-based company called Akeso, Summit entered into an agreement with the former to license the drug in certain countries, including the U.S., in exchange for an up-front payment, potential development and sales milestones, and royalties. Ivonescimab is already approved in China for a particular variant of lung cancer.

It recently aced a phase 3 clinical trial in the country in treating another variant of non-small cell lung cancer (NSCLC). Ivonescimab was pitted against Merck's Keytruda, the standard of care in NSCLC and the best-selling drug in the world since last year, in this phase 3 study.

In the trial, ivonescimab led to a median progression-free survival of 11.14 months, compared to Keytruda's 5.82 months. It also reduced the risk of disease progression or death by 49% compared to Keytruda and posted a similar safety profile.

According to Summit, ivonescimab is the first drug to post better clinical results than Keytruda in a phase 3 study in NSCLC.

Ivonescimab's potential

Although Keytruda has earned dozens of indications worldwide, NSCLC is unquestionably one of its biggest growth drivers. According to the World Health Organization, lung cancer was the second most-common cancer in the world as of 2020. However, it was the leading cause of cancer death.

About 85% of lung cancer cases are of the NSCLC variety. In 2017, about 40% of Keytruda's sales came from the various indications it has earned in treating NSCLC, although that has likely changed as the drug's indications expanded.

But using this as a baseline, and considering that Keytruda generated $25 billion in sales last year, about $7 billion to $10 billion of it could have come from NSCLC indications. Ivonescimab, if approved in the U.S., Canada, Japan, and other countries where Summit owns the rights to license it, could capture much of that revenue and redirect it toward Summit's financials.

The medicine is also being investigated in other indications, including colorectal cancer, the second leading cause of cancer death in the world.

Is Summit a buy?

There is no question that Summit has a winner in ivonescimab, a medicine that could become a "pipeline in a drug," just like Keytruda. The problem for investors is that the market has already priced some of ivonescimab's success into the shares. Despite not having a single drug on the market, the company is worth $17 billion. The stock could fall off a cliff at these levels if anything goes wrong with its leading pipeline candidate.

The good news is that funding likely won't be an issue. Summit ended the second quarter with $325.8 million in cash and equivalents, which the company said could help it run its operations until the fourth quarter of 2025. Since then, it has raised even more money, taking advantage of ivonescimab's recent success.

Summit Therapeutics does look a little risky, but ivonescimab's potential makes it worth it for biotech investors who can stomach the risk. If the company can continue posting ivonescimab-related wins, the stock might be highly lucrative in the long run.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.