Retail data released today shows a boost in sales, but the news offers little comfort for one troubled ASX stock.

According to the Australian Bureau of Statistics, retail turnover increased 0.6% in May. As my colleague Bernd Struben noted, retailers won't be celebrating yet, with much of the growth attributed to shoppers cashing in on discounted end-of-year sales.

It's a relatively uninspiring update for ASX retail shares. The data indicates an industry still hobbled by high interest rates, an environment that has partially slain another Australian business today.

Which ASX stock is looking for a lifeline?

The outcome of a strategic review at Booktopia Group Ltd (ASX: BKG) has been announced after the company entered a trading halt on 13 June.

Australia's largest online bookstore has entered voluntary administration.

As per the announcement, Booktopia is now in the hands of specialist advisory and restructuring firm McGrathNicol.

Partners Keith Crawford, Matthew Caddy, and Damien Pasfield are the acting administrators conducting an 'urgent assessment' of Booktopia's options, including a sale or recapitalisation of the company.

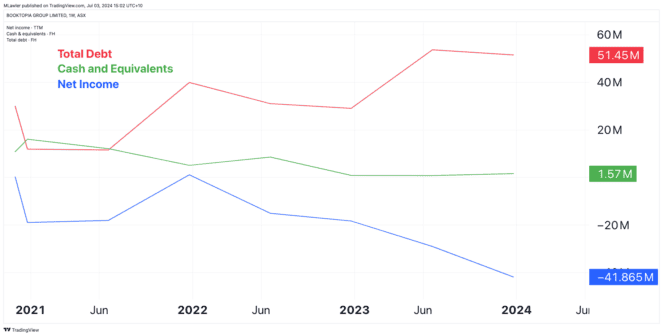

The dire situation follows more than three years of lacklustre performance since the stock popped onto the ASX. During this time, the company's debt has grown alongside a dwindling cash pile, consumed by unprofitable operations, as depicted in the chart above.

On 31 March 2024, Booktopia had $212,000 in cash and $959,000 in undrawn finance facilities. However, based on recent negative free cash flows, this would be enough to last a month or two.

What's next?

Trading in Booktopia shares will remain suspended while the administrators try to revive the struggling business. By Monday, 15 July, a meeting with creditors, entities to which Booktopia owes money, will occur.

The ASX stock is down 72% over the last year. For those who have been invested since its public debut, shares are 98.4% lower, last trading at 4.5 cents apiece.