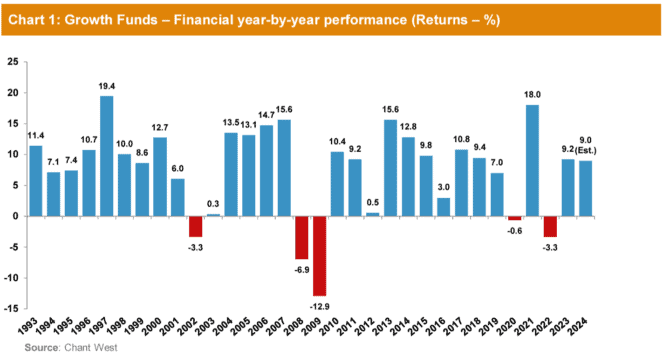

Superannuation 'growth' funds look likely to deliver a median 9% return in FY24, according to Chant West research.

Growth funds are superannuation funds made up of 61% to 80% growth assets like ASX shares.

In FY23, growth funds delivered a median 9.2% return.

Let's look into the details.

Resilient share markets drive FY24 superannuation returns

FY24 is set to become the 13th year of positive superannuation returns out of the past 15 years.

Chant West Senior Investment Research Manager Mano Mohankumar says resilient share markets have driven the strong FY24 result.

International shares have been the stand-out category for growth, with the S&P 500 Index (SP: .INX) up 25.85% over the past 12 months compared to a 10.39% gain for the S&P/ASX 200 Index (ASX: XJO).

Mohankumar commented:

A final result close to 9% would be an excellent outcome given all of the uncertainty around inflation, expectations of when the Fed will start cutting interest rates and ongoing geopolitical tensions.

The experience over the past two years is another reminder of the importance of remaining patient and not getting distracted by shorter-term noise.

If you think back to nearly two years ago, FY22 closed with some sharp losses over the June quarter amid surging inflation and uncertainty as to when interest rate rises might come to an end.

At that time, very few could have foreseen a return of 19% over the subsequent two years.

The following chart shows the annual median returns of growth superannuation funds over 30 years.

Mohankumar commented that since the introduction of the Superannuation Guarantee, the median growth fund has returned 7.9% per annum.

The annual inflation or consumer price index (CPI) increase over the same period was 2.7%.

This means a real return of 5.2% per annum to superannuation investors.

This is well above the typical target of 3.5% per annum.

He adds:

On the risk side, there have only been five negative years over the entire period, which translates to about one year in every six.

Again, funds have done better than their typical long-term risk objective which is one negative return in every five years, on average.

Some workers prefer higher-risk superannuation funds, such as those with 96% to 100% of monies invested in growth assets ('super growth' funds) or those with 81% to 95% in growth assets ('high growth' funds).

Others take a more conservative approach, selecting balanced funds with 41% to 60% of monies invested in growth assets and the rest in defensive assets such as cash and bonds.

Balanced funds are typically the default option for workers who do not nominate a superannuation strategy themselves.

Balanced funds and conservative funds (21% to 40% growth assets) are popular with workers close to retirement, given they usually want to preserve their superannuation savings as much as possible.