The amount of money in our superannuation account when it's time to retire will dictate whether we see out our days comfortably, modestly, or minimally.

Without a shadow of a doubt, our super balance is the most important factor for a successful retirement for the average Australian. Yet, many of us will take our employer's contribution and call it a day, hoping it will work out in the wash. Unfortunately, hope alone is not a sound retirement strategy.

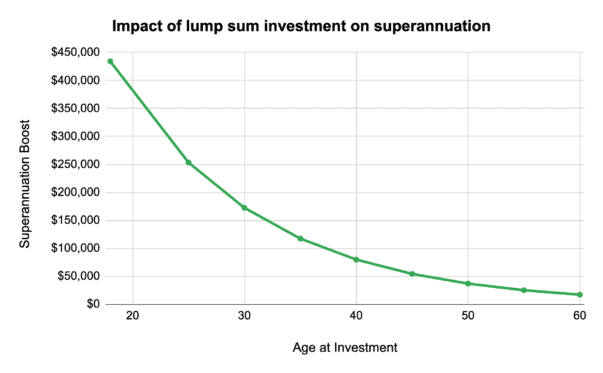

A little extra effort towards planning retirement can go a long way. Most of the hard work is taken care of by compounding. Compounding is the secret ingredient to turning $10,000 into $434,000 of superannuation.

Imagine how much more living could be had with an extra $434,000 in retirement.

1 simple step to boosting superannuation by $434,000

The power of compounding is truly remarkable. Its powerful effect on wealth creation is most potent when applied as early as possible. In the superannuation context, this point of highest potency begins at 18 years old — when super becomes mandatory irrespective of hours worked.

Here's the trick to supercharging a super balance — using pre-tax or after-tax contributions.

If an additional $10,000 were invested at 18 years old, this amount would have compounded to $434,000 by retirement age (assuming an 8% compounded return).

For some perspective, the average Australian superannuation balance in FY21 for people aged between 65 and 69 was $428,738. That means a single investment could surpass the current 65 to 69-year-old demographic's super balance before any employer contributions.

The boost to superannuation extends beyond the age of 18. While compounded returns are not quite as sweet, they can still make a noticeable difference.

The same approach taken at 25 can boost retirement savings by $252,395 when compounded at 8% per annum, as shown above. Likewise, a $10,000 contribution to a super balance at the age of 30 can bump the balance by $172,456 when retirement rolls around.

What if retirement is just around the corner? It's arguably still a worthwhile investment.

$10,000 added to superannuation at 60 can grow to $17,138 by 67 if an 8% compound return is achieved. I wouldn't turn my nose up at $7,138 extra in retirement.