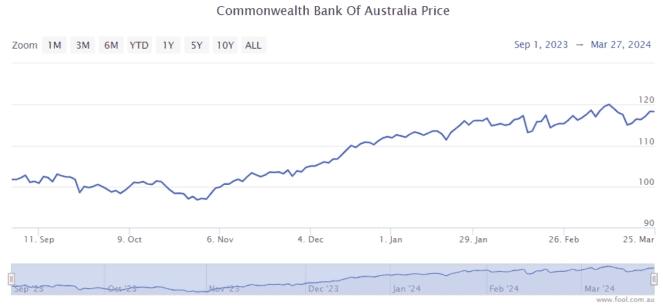

The Commonwealth Bank of Australia (ASX: CBA) share price has done very well for shareholders – it's up 4% in 2024 to date and it has gone up 18% in the last six months. The S&P/ASX 200 Index (ASX: XJO) has only risen by 10% in the past six months.

A lot of ASX stocks have gone up in the last few months, but there may be an explanation for the rally.

Reasons for the rise

MST Marquee analyst Brian Johnson was speaking at the Australian Financial Review Banking Summit.

Earlier in the month, the CBA share price reached above $121. The banking analyst acknowledged CBA is "the best bank", but there's more to it than that.

He said there has been more buying than selling since October when ASX bank shares were unloved – credit growth was slow, net interest margins (NIM) were falling and banks were agreeing to sizeable pay rises which would increase labour costs. Johnson said he had never seen a time of a worsening revenue outlook while costs were also going up.

Then, in November, it seemed that the US Federal Reserve was pivoting and was starting to think about cutting interest rates.

This change meant global funds which had a smaller position of ASX bank shares decided to rethink their weighting, and they bought (CBA) shares because of the rising Australian dollar and the easing fears about Australian house prices. This also created a squeeze for CBA shares, leading to short sellers needing to cover their positions.

On top of that, according to Johnson, there were growing fears about the Chinese economy earlier this year, which meant Asian investors decided to look at markets outside of China, such as Australia and India. They also decided to buy ASX bank shares, like CBA.

CBA itself reportedly added to the buying by buying CBA shares for the dividend re-investment plan (DRP).

While there was a big increase in buying, there weren't many sells thanks to CBA's "sticky" share register, with some long-term investors not wanting to trigger a capital gains tax bill.

Johnson was quoted by the AFR who said:

CommBank has always been expensive – best management, generates the most capital and no one owns it which means you perpetually get in these periods where people have to buy it and get squeezed up.

If you think about every single one of those drivers, has anything changed?

The credit growth outlook is still slow, we still see outrageous competition coming through on both sides [mortgages and deposits]. Not much has really changed except the share prices are a lot higher.

CBA share price valuation

Using the independent estimates on Commsec, the CBA share price is valued at 21 times FY25's estimated earnings. This is a very high price/earnings (P/E) ratio for a bank, and I think it has brought forward capital growth. It could be difficult to deliver much more increases in the next year or two.

Considering CBA's profit is expected to fall in FY24 and FY25, I'd be looking at other ASX shares for value.