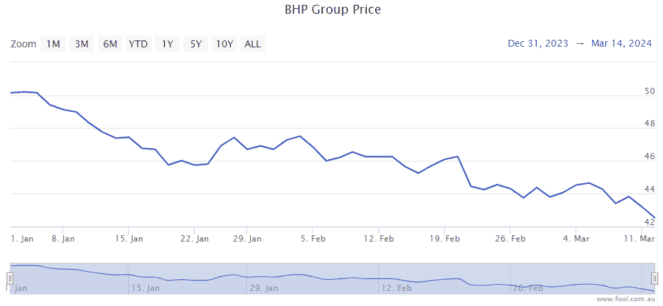

The BHP Group Ltd (ASX: BHP) share price has gone backwards by 15% in 2024. After a difficult couple of months for the ASX mining share, is it time to buy?

BHP has suffered from a falling iron ore price, as well as large one-off costs in its FY24 first-half result which included a write-down of its nickel assets, and more costs allocated for the Samarco disaster in Brazil.

Is the BHP share price a buy?

According to reporting by The Australian, the broker Citi has changed its rating on the ASX iron ore share to a buy, though its price target was unmoved at $46.

A price target is where the broker thinks the share price will be in 12 months.

At the current BHP share price – which is up more than 2% today at the time of writing – that would suggest a potential rise of close to 7% over the next 12 months. Any dividends paid would be a bonus on top of that.

Citi analyst Paul McTaggart said that BHP "now looks cheap enough" based on normalised valuation multiples.

The Australian reported McTaggart noted the enterprise value to earnings before interest, tax, depreciation and amortisation (EBITDA) ratio is 5 times, compared to the long-term average of 6.3 times. The price to cash flow ratio is 6.4 times, compared to the long-term average of 8 times.

In other words, if we look back at history, BHP is looking materially cheaper than it has in the past, based on those two ratios.

However, at the same time, Citi didn't say that BHP was the cheapest ASX iron ore share. McTaggart explained:

We stay buy rated on Rio Tinto Ltd (ASX: RIO) and note it is still the cheapest of the large iron ore exposures with the highest mid-term production growth.

Other valuation metrics

According to the estimates on Commsec, the BHP share price is valued at 10 times FY24's estimated earnings with a possible grossed-up dividend yield of 7.9% in FY24. We'll have to see if Citi is right about the positive outlook for this ASX share over the next year.