BHP Group Ltd (ASX: BHP) shares are in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed yesterday trading for $42.41. In late morning trade on Tuesday, shares are changing hands for $42.73 apiece, up 0.8%.

For some context, the ASX 200 is down 0.1% at this same time.

ASX 200 investors look to be buying BHP shares today following a rebound in the slumping iron ore price. The steel-making metal gained 4.1% overnight to trade for US$104.00 per tonne.

BHP produces iron ore at a lower cost than any other global miner. And its iron ore division – BHP's biggest revenue earner – remains well in the profit zone at these levels.

For its half-year results, the ASX 200 miner reported underlying profit in line with the prior corresponding period, at US$6.6 billion

Its nickel operations are another story entirely. With nickel prices crashing amid a ramp-up in cheap and "dirty" nickel from Indonesia (largely funded by Chinese companies), BHP recorded a US$2.5 billion impairment for its Western Australia Nickel project.

And looking ahead, the ASX 200 miner warns that the high costs of doing business in Australia could impact all of its operations and pressure BHP shares unless legislative changes are made.

Growing global mining competition

At its shareholders presentation yesterday, BHP addressed the pressure from an oversupply of nickel.

The ASX 200 miner is considering shuttering Nickel West. That would see some 3,000 employees lose their jobs until such a time as nickel markets come back into balance.

BHP CEO Mike Henry said Nickel West was operating at significant losses and needed major upgrade investments.

"We've got the need for a major smelter rebuild coming towards us, which is many hundreds of millions of dollars in capital expenditure. Looking at this we've said it clearly isn't sustainable," Henry said (quoted by The Australian).

Retiring CFO David Lamont added, "30% of the Australian nickel market has gone offline and another 30% is under pressure."

On a broader and longer-term scale, BHP shares could face additional headwinds heading into 2030 amid increasing competition as more Chinese-backed mines in Africa commence production.

The ASX 200 miner warned that Australia's industrial relations regulations and tax systems need to be reworked so its domestic operations remain globally competitive.

According to Lamont:

In Australia at the moment, we are facing one of the highest corporate tax rates. And then when you overlay that with royalty regimes that exist at a state-based level, we do get some very high effective tax rates.

In Queensland at the moment, it's in excess of 62% as the effective tax rate. So it's a high taxing regime. Against that, we've got to see the reward balancing out against that risk exposure that we have.

Then there are the high labour costs associated with BHP's Australian-based operations. Those were reported to be as much as 15% higher than labour costs in the United States and Canada. But without a corresponding uplift in productivity.

"For us to remain competitive in these globally contested markets, there has to be a commensurate productivity uplift associated with that," Henry said (quoted by The Australian).

"That's where we think at times policy can get in the way of enhancing productivity, and that's our fear about some of the recent changes that are being pursued here in Australia," he added.

Incoming chief financial officer Vandita Pant said that with Chinese demand reaching a plateau and more supply coming online from Africa later this decade, BHP was focused on becoming more competitive.

"We are very well positioned for that," she said.

And Pant added that new markets, like India, offer potential growth opportunities for BHP shares.

According to Pant:

As India continues to build its country's infrastructure, manufacturing base, steel will continue to increase in production in India. We expect the Indian production of steel to double by the end of this decade.

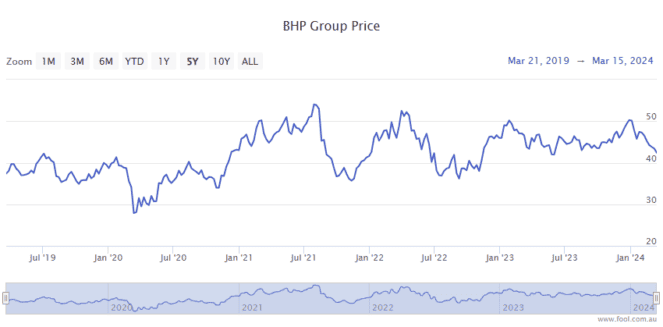

How have BHP shares been tracking?

BHP shares are down 16% in 2024 amid a sharp fall in iron ore prices. Shares in the ASX 200 miner are just about flat over the past 12 months.