The Mineral Resources Ltd (ASX: MIN) share price is in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock and diversified resources producer closed Friday trading for $65.91. In early trade on Monday, shares are swapping hands for $66.42 apiece, up 0.8%.

For some context, the ASX 200 is down 0.3% at this same time.

This comes following the announcement of a proposed lithium acquisition.

Here's what we know.

ASX 200 miner to acquire Lake Johnston

The Mineral Resources share price is moving higher after the company reported it has entered into a binding heads of agreement to acquire the Lake Johnston nickel concentrator plant and tenure from Poseidon Nickel Ltd (ASX: POS).

The Poseidon Nickel share price is tumbling on the news, now 12%.

Mineral Resources plans to develop Lake Johnston as a lithium processing hub in the southern Goldfields region of Western Australia.

The company noted that the nickel concentrator plant has a flotation circuit with a front-end capacity of 1.5 million tonnes per annum. And it can be converted to treat lithium ores, including dense media separation fines.

The ASX 200 miner will pay Poseidon Nickel $1 million on execution of the agreement, $6.5 million on completion of the sale and purchase, and $7.5 million 12 months after completion.

Commenting on the proposed acquisition that looks to be helping boost the Mineral Resources share price today, managing director Chris Ellison said:

This is an exciting opportunity to develop MinRes' third lithium processing hub in the Goldfields and the first to include flotation capacity to treat fines.

We intend to bring our expertise in spodumene production to Lake Johnston, which has the potential to service projects throughout the world's most prospective region for lithium.

Poseidon Nickel CEO Craig Jones said that atop the $15 million in cash, the junior miner will retain "an exposure to any exploration success at Lake Johnston with royalties from any future minerals or metals production from the project tenements".

Under the proposed agreement, Poseidon will receive 0.75% FOB royalty on lithium minerals and 1.5% net smelter return royalty on all other minerals and metals extracted from the Lake Johnston tenements.

Lake Johnston is licensed to operate until 2041.

Mineral Resources share price snapshot

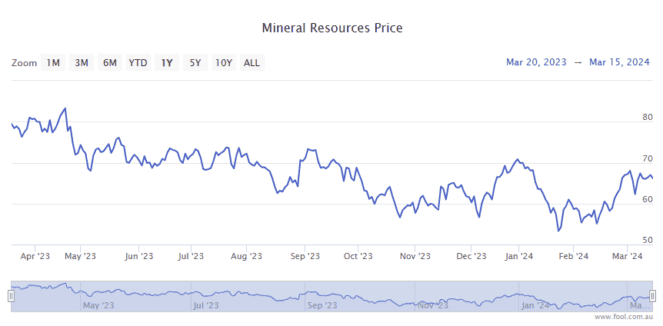

Despite its diversified mining assets, the Mineral Resources share price has not escaped the pain of plunging lithium prices.

Over the past 12 months, shares in the ASX 200 miner are down 14%. Shares are up 26% since the recent 22 January lows.