As a human who follows the news, it wouldn't have escaped your attention that artificial intelligence (AI) has been making headlines for the past 16 months.

The difficulty is that on the ASX there aren't that many technology shares that are directly involved in making AI.

However, the great news is that there are plenty that are involved in the supply chain.

And many experts argue that it's far better to invest in companies that produce the "picks and shovels" anyway, because it means you don't have to choose a winner among the AI producers.

Here are two that I can think of:

The computers producing AI have to live somewhere

NextDC Ltd (ASX: NXT) is an Australian data centre operator founded by Bevan Slattery, who is also the entrepreneur behind Megaport Ltd (ASX: MP1) and Superloop Ltd (ASX: SLC).

Artificial intelligence requires a tremendous amount of computing capacity to crunch all the necessary calculations.

And all that computing power has to be housed somewhere.

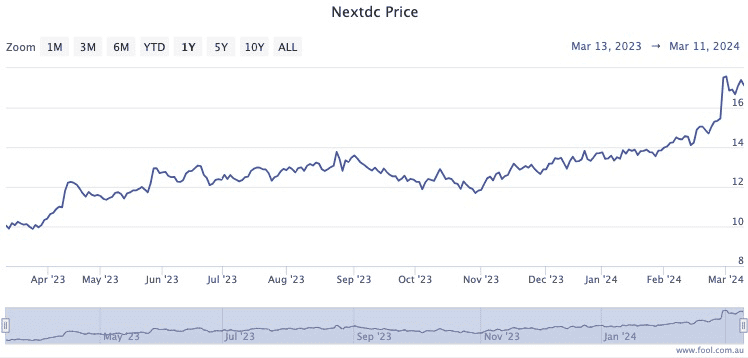

That's where NextDC comes in, and likely explains the share price doubling since November 2022, when ChatGPT was released to the public.

Despite the steep rise in the valuation, professional investors are judging that data centre demand will skyrocket in the coming years.

This conviction is shown on broking platform CMC Invest, which shows a whopping 15 out of 17 analysts recommending NextDC as a buy.

And all those data centres have to live somewhere

Even higher up in the supply chain is industrial real estate developer Goodman Group (ASX: GMG).

While it has become widely successful on the back of renting out warehouses for online shopping, the potential of data centres has not escaped the business.

Goodman has publicly acknowledged that data centre space is a focus area for its future growth.

Just last month, chief executive Greg Goodman recognised the coming demand from AI.

"As the digital economy expands with the growth of artificial intelligence and increased computing requirements, so does our ability to provide the essential infrastructure needed to support its progress," he said.

"Our growth in data centre capacity underscores our ability to deliver digital infrastructure, where we're securing power on our sites and developing data centres in cities with high demand."

Like NextDC, the Goodman share price has also climbed rapidly over the past 16 months, to the tune of a 91% gain since the start of October 2022.