This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

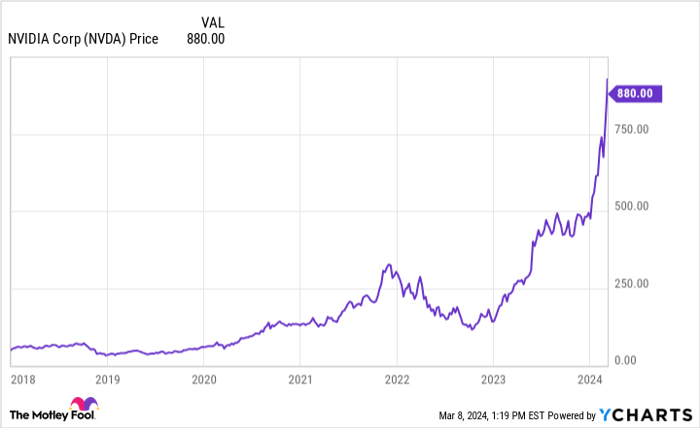

Nvidia (NASDAQ: NVDA) stock looks unstoppable. Amid the company's dominance in artificial intelligence (AI)-ready chips and the insatiable demand for the technology, its stock has risen by close to 300% over the last 12 months.

With the stock approaching $1,000 per share, investors may wonder whether a stock split is imminent. Despite the fact that such a move will not directly influence Nvidia's valuation, investors should expect one soon. Here's why.

Nvidia and stock splits

The history of Nvidia stock is arguably the most compelling reason for expecting a near-term split. The company has split its stock five times since 2000, one of which has occurred since AI and data centers renewed investor interest in GPUs.

That previous split occurred on July 19, 2021, when Nvidia carried out a 4-for-1 stock split. Interestingly, it closed at a pre-split price of around $744 per share that day, a level lower than today's current price.

Still, investors should remember that these gains came quickly, as Nvidia stock is up about 85% this year and nearly 30% over the last month alone, indicating that a need for a split could have caught the company's board off guard.

The big question surrounding the split

Moreover, the most significant question surrounding a split is likely where the company will set the split ratio. The most recent 4-for-1 split was the largest ratio in the company's history, with the company having approved three 2-for-1 splits and one 3-for-2 split in the 2000s.

However, as mentioned before, the more recent growth has probably exceeded expectations. While future growth may not match the 126% revenue increase in fiscal 2024 (ended Jan. 31), analysts forecast 81% revenue growth in fiscal 2025 and 22% the next fiscal year, indicating the massive profit increases should continue for the foreseeable future.

That could possibly mean the stock price is not done rising. Conversely, slowing growth could soon dampen enthusiasm for the stock, and the company's board will have to consider the massive drops in the stock price in past years. Hence, the company has to be ready for any potential price movement when it decides the split ratio.

Another possible consideration

Investors may want also to consider another possible factor -- inclusion as one of the 30 stocks making up the Dow Jones Industrial Average.

The S&P Dow Jones Indices, operated by S&P Global, has not telegraphed any intention to add Nvidia to the Dow 30. Also, the index already includes two semiconductor stocks, Apple and Intel.

However, Intel has struggled in recent years, increasing the chances of its removal. Also, AI's influence over the economy could lead to more tech stocks in the index, and Nvidia's $2.2 trillion market cap makes it a likely choice.

Furthermore, the Dow 30 is a price-weighted index. Since the nominal share price determines a stock's weighting on the Dow, companies have often initiated stock splits to reduce their influence over the index. Should Nvidia seek a place on the Dow 30, it may alter the split ratio to increase its chances of inclusion.

Making sense of a potential stock split

Given the company's history of stock splits, investors should expect such a move sooner rather than later. Also, since the previous split occurred less than three years ago at a lower price, the split ratio is likely the most significant question surrounding such a move.

Indeed, Nvidia's board will need to consider the stock's price history in deciding the ratio, both in a positive and negative sense. Also, assuming Nvidia seeks to become a Dow 30 stock, it will have to become more sensitive to its nominal share price.

Ultimately, the stock split changes nothing for Nvidia on the surface. However, given the company's history, shareholders should anticipate a split and, possibly, increased interest in the stock from some unexpected parties.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.