BHP Group Ltd (ASX: BHP) shares are popular among passive income investors for their reliable, fully franked dividends.

Most recently, the S&P/ASX 200 Index (ASX: XJO) mining giant declared a $1.10 per share interim dividend.

If you owned shares at market close on 6 March, you can expect that passive income to hit your bank account on 28 March. BHP shares traded ex-dividend on Thursday.

The interim dividend was down 20% from the prior year, impacted by US$5.6 billion of exceptional items expenses. Taking out those exceptional items, underlying profit came in at similar levels to the prior corresponding half year, at US$6.6 billion.

Revenue for the six months was up 6% to US$27.2 billion.

Atop the interim dividend, BHP shares also delivered a final dividend of $1.25 per share. That was paid out on 28 September.

That equates to a full-year payout of $2.35 per share.

At Friday's closing price of $43.89 a share, this sees BHP, the biggest stock on the ASX 200, trading on a fully franked trailing yield of 5.3%.

So, how are these passive income investors earning almost 9%?

Brave passive income investors earning supercharged yields from BHP shares

The answer lies in the title of this article, or the subhead above.

Namely, that they were brave.

And, undoubtedly, more than a little lucky with their timing in buying BHP shares.

Now, trying to time the lows for ASX stocks is fraught with difficulty. If you get it wrong, you can buy into a stock that still has a long way to fall. Alternately, you might find yourself on the sidelines watching the stock roar higher, having missed the low point entirely.

However, there are times when quality stocks, like BHP, are beaten down for no reason relating to their long-term prospects. And history has shown these tend to be opportune periods to go stock shopping.

One such time was in March 2020, during the early weeks of the global pandemic-driven market rout.

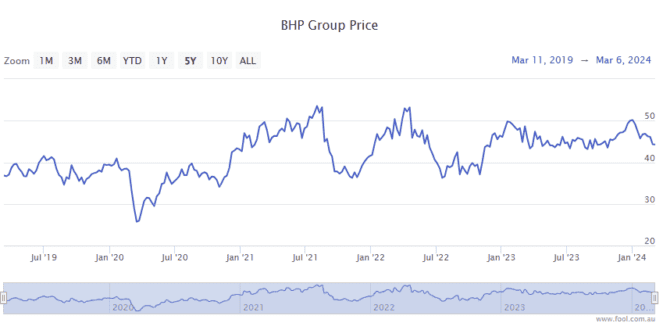

Gripped by fear, investors sent BHP shares tumbling by 34% in a matter of weeks.

On 13 March 2020, that saw the ASX 200 miner close the day trading for $26.72 a share.

But not everyone was fearful.

Today the brave passive income investors who recognised a bargain when they saw it and bought after that sell-off are earning the same dividends from those BHP shares as investors who bought stock this week.

That means they're earning a fully franked yield of 8.8% from those shares.

They'll also have watched as that bargain-priced stock soared 64% over the past four years!