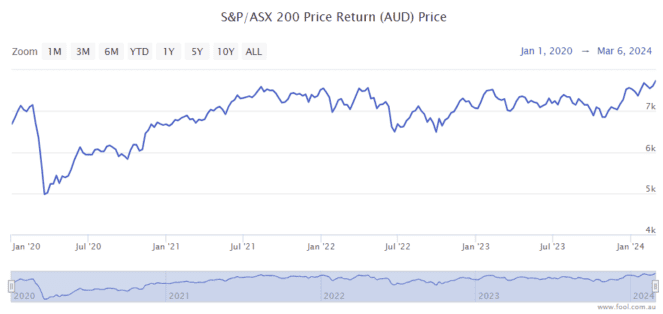

The S&P/ASX 200 Index (ASX: XJO) is very close to its all-time high right now, closing the trading day at 7,733.5 points on Wednesday. Would Warren Buffett buy ASX shares at these prices?

Firstly, I don't think Warren Buffett would actively buy something because it's at an all-time high.

Keep in mind that a company's share price can go up and be cheap, or go down and be expensive. It's more about the value on offer than the price.

Don't swing at every pitch

One of the most helpful pieces of advice that Buffett has said about this topic is a comparison between baseball and investing. Essentially, you don't have to swing at every baseball delivery. The investing legend once said:

The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, 'Swing, you bum!,' ignore them.

Buffett referred to a book by one of the great baseball batters, Ted Williams, who waited for the right pitch to swing at, rather than going for the wrong pitches. Buffett said:

If he waited for the pitch that was really in his sweet spot, he would bat .400. If he had to swing at something on the lower corner, he would probably bat .235.

Of course, that's not to say that we can't find opportunities during this time. There are lots of good businesses that we can invest in. I'm still investing, even if they're not as cheap as four or five months ago.

Is it good value?

Good companies should be able to grow their earnings and deliver decent investment returns, in my opinion. But we shouldn't buy an ASX share at any price. Buffett once explained:

For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.

But if the price is good enough, it can deliver good returns and hopefully outperform. As Buffett said:

It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.

My 2 cents on whether Warren Buffett would buy ASX shares today

I think he'd be less willing to buy ASX shares today than if the question was posed in October 2023.

However, the ASX share market being at an all-time high wouldn't stop him from buying if he could see a good opportunity.

I don't know which ASX shares Buffett would invest in this week, but I do know what I'm going to buy next. I'll write about that next week when trading rules allow.