Commonwealth Bank of Australia (ASX: CBA) shares closed yesterday at a new all-time high of $118.12.

In early afternoon trade on Tuesday, shares in the S&P/ASX 200 Index (ASX: XJO) bank stock have slipped a touch from those levels, trading for $118.10 apiece.

Despite numerous analysts cautioning that the biggest of Australia's banks trades at an unjustifiable premium to its peers, investors have continued to hit the buy button since CommBank reported its half-year results on 14 February.

The highlight of those results for passive income investors was the 2.4% year on year boost to CBA's interim dividend. That came out at $2.15 per share, fully franked. Eligible investors can expect to see this hit their bank account on 28 March.

Atop the boosted interim dividend, CBA's final dividend of $2.40 per share (paid on 28 September), was up 14.3% from the prior final dividend.

With the full-year payout of $4.55 per share, CBA shares trade on a fully franked trailing yield of 3.9%.

So, how are some passive income investors earning a 7.9% yield?

Buying CBA shares when everyone is selling

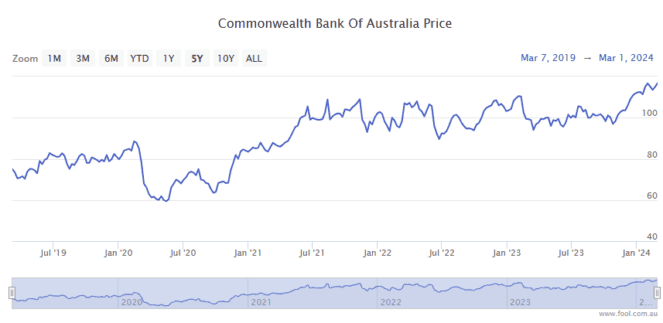

Not many ASX 200 investors were buying stocks during the final weeks of the COVID-19 market meltdown in 2020. Hence the 33% plunge in the benchmark index over a matter of weeks.

Indeed, trying to time the market and buy in at the lows often sees investors sitting on the sidelines after the market has already turned around.

But passive income investors who saw through the selling madness in early 2020 and swallowed their fears to buy quality, beaten-down stocks at absolute bargain levels tend to have been richly rewarded for their bravery.

Take CBA shares, for example.

On 27 March 2020, the ASX 200 bank stock closed the day trading for $57.66 per share.

And shares bought at that price will have earned the same $4.55 in fully franked dividends over the past 12 months as the shares bought at over $100 in 2023.

Meaning those brave investors will be earning a 7.9% yield from the CBA shares bought at bargain basement prices.

Not to mention the 105% share price gain they'll have enjoyed since then!