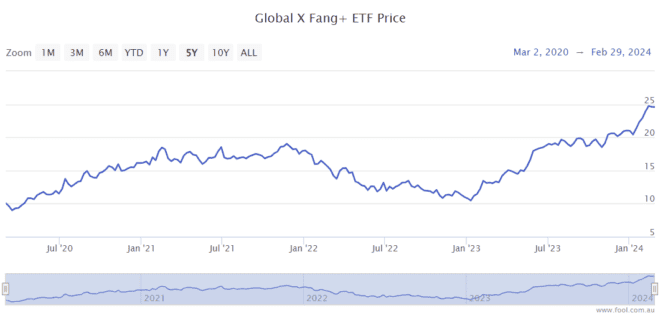

The Global X Fang+ ETF (ASX: FANG) has been one of the best-performing exchange-traded funds (ETFs) on the ASX over the past year. It's not far off doubling in value, as we can see on the chart below.

This fund gives significant exposure to large US technology businesses, including Nvidia, Meta Platforms, Netflix, Broadcom, Amazon.com, Microsoft, Alphabet, Snowflake, Apple and Tesla.

Let's consider the positives and negatives of buying units of the FANG ETF right now.

The positives

This ETF gives investors a concentrated exposure to some of the world's strongest businesses. The smallest allocation is just over 7% to electric vehicle pioneer Tesla, while its largest position is AI market leader Nvidia, with a 14% weighting.

These businesses have performed very well for investors as they invent and develop new technologies and services. When companies are driving national (or global) change, I think they're more likely to be able to generate profit growth and drive shareholder returns.

Over the three years to 29 February 2024, the FANG ETF delivered an average return per annum of 19%. Of course, past performance is not necessarily a reliable indicator of future returns.

I think it has a very reasonable management fee of 0.35%, which is cheaper than the 0.48% annual fee charged by Betashares Nasdaq 100 ETF (ASX: NDQ).

Aussies don't have the option of many large technology businesses on the ASX, so this investment could be a good way of gaining that allocation.

And negatives

If investors are picking this investment for diversification, it doesn't offer a lot – the FANG ETF only owns 10 names, and they're all tech businesses or tech-related.

While its share price has lifted significantly in recent times, a sell-off could hit the valuations harder than the overall market. Tech stocks can be very volatile, like we saw in 2022.

According to its provider Global X, the FANG ETF had a price/earnings (P/E) ratio of around 46 on 31 January 2024. That seems high compared to other investments. The price-to-book ratio was 11.7x at the end of January 2024.

Foolish takeaway

There's a danger of overpaying for the businesses in this portfolio, particularly in the short term. But, I think the long-term looks very promising. I'd call it a long-term buy, but the short-term could be volatile and uncertain.