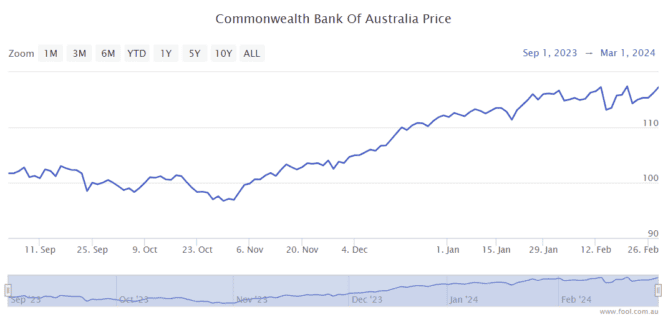

Commonwealth Bank of Australia (ASX: CBA) stock has performed very well for shareholders in the last few months. It's up around 15% in the past half-year period.

Everyone already knows that CBA pays dividends. In the FY24 first-half result, it grew its interim dividend by 2% year over year to $2.15 per share. The (independent) forecast on Commsec is that owners of CBA stock could get an annual dividend per share of $4.55 in FY24, which translates into a projected grossed-up dividend yield of 5.6%.

But, there's a lot more to know about CBA than just its dividend if you own shares or are thinking about buying.

Arrears are rising

Past performance is not necessarily going to be a reliable indicator of future performance when it comes to the CBA stock price, its profit margins or its 'normal' arrears rate.

The banking sector is seeing strong competition, which is putting pressure on margins. But, the biggest talk point in the 2024 calendar year could be concerns about how high arrears are going to go.

If more borrowers struggle to make payments, that means less cash flow and less profit for the bank.

CBA itself said it's expecting the financial strain from higher interest rates "to continue in 2024, with an uptick" in arrears and impairments.

At December 2022, the percentage of home loans that were overdue by at least 90 days was 0.43%, it reached 0.47% at June 2023 and had risen again to 0.52% by December 2023. I hope it doesn't keep rising, but there's a danger it might, which could hurt CBA stock. The recent November RBA rate rise's impact may take a bit of time to show on CBA's lending metrics.

In the HY24 report, CBA increased its total impairment provisions to $6.06 billion, up from $5.95 billion as at 30 June 2023.

Very high-quality bank

While the lending environment may be competitive and a little more uncertain, what I know for sure is that CBA is one of the highest-quality banks. It's a leader in Australia, and I'd call it one of the strongest in the world, though I don't know every single bank out there.

There are a number of metrics that show me that CBA is a great bank.

CBA reported it made a return on equity (ROE) – on a cash basis – of 13.8%. That shows us how much profit the bank made compared to how much shareholder money is retained in the business. As a comparison, the underlying ROE for Westpac Banking Corp (ASX: WBC) in the second half of FY23 was 9.9%.

For the FY24 first-half result, CBA reported a net interest margin (NIM) of 1.99%. While this was down from 2.10% in HY23, it shows the bank is still making a solid profit and it's not going too hard on competing – it's finding the right balance for shareholders.

The bank satisfies a large portion of its funding requirements from customer deposits, which accounted for 75% of total funding, with increases primarily from retail customers. Customer deposits are considered the most stable source of funding. At December 2019, the deposit funding ratio was 71%, and it was 55% in June 2008 (at the time of the GFC).

Very high price

CBA is priced for its quality, some investors might say it is overpriced.

According to the forecast on Commsec, CBA stock is valued at 20 times FY24's estimated earnings. CBA will need to do very well over the next couple of years to justify this price. As a comparison, the Westpac share price is only valued at 14 times FY24's estimated earnings.

The price/earnings (P/E) ratio is expensive by itself, and high compared to other banks. Indeed, it's one of the most expensive banks in the world. We can't expect the P/E ratio to keep rising.