The Star Entertainment Group Ltd (ASX: SGR) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) casino operator closed yesterday trading for 48 cents. In early trade on Thursday, Star Entertainment shares are swapping hands for 50.5 cents apiece, up 5.2%.

For some context, the ASX 200 is down 0.26% at this same time.

This follows the release of Star Entertainment's half-year results for the six months ending 31 December (H1 FY2024).

Here are the highlights.

Star Entertainment share price gains alongside balance sheet

- Net revenue of $866 million, down 14.6% year on year

- Earnings before interest, taxes, depreciation and amortisation (EBITDA) before significant items of $114 million, down 43.1% from 1H FY 2023

- Net profit after tax (NPAT) before significant items of $25 million, down 42.7% year on year

- Significant items after tax a loss of $15.9 million, compared to a loss of $1.307 billion in the prior corresponding period

- Net cash position of $171 million as at 31 December, up from a net debt position of $596 million as at 30 June

What else happened during the half?

On the plus side of the ledger, and likely helping lift the Star Entertainment share price today, was the company's statutory NPAT of $9 million, up from the massive significant item impaired net loss of $1.264 billion in 1H FY 2023.

Star Entertainment also continued to make progress with remediation over the six months, with the company's remediation plan approved in Queensland.

In New South Wales, the proposed casino duty rate uncertainty was resolved. The company said the new arrangements remove the "considerable uncertainty" introduced in December 2022 and will protect the jobs of thousands of its Sydney employees.

Importantly, the half-year also saw a successful $750 million equity raising alongside $450 million debt refinancing. All of Star's existing debt was cancelled, with management reporting the new debt had been secured "on more favourable terms".

Also aiding the balance sheet was the $56 million secured from the sale of Sheraton Grand Mirage.

What did management say?

Commenting on the results lifting the Star Entertainment share price today, CEO Robbie Cooke said, "While the group continues to operate in a challenging regulatory environment, The Star has achieved a number of significant milestones in the period."

Cooke added:

Notwithstanding these achievements, there is still much work to be done. Remediation remains our number one priority. We continue to uplift our risk management, safer gambling and AML capabilities and are starting to embed greater accountability and more robust governance…

In terms of trading performance, earnings have maintained the run rate experienced on exiting Q4 FY23 with EBITDA of $114 million in the half. The start of this calendar year has seen revenue and earnings continue to track our first half run rate.

Star Entertainment share price snapshot

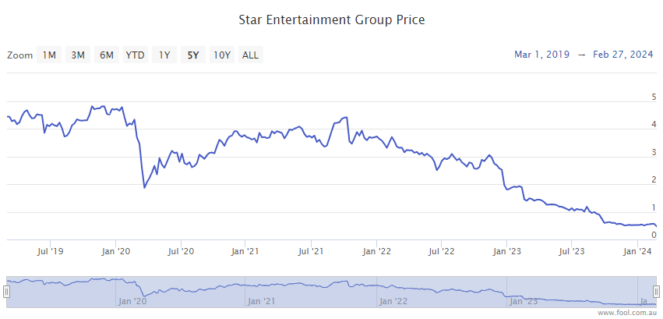

Despite today's welcome lift, the ASX 200 Casino Operator has a long way to go to recoup recent losses.

The Star Entertainment share price is down 62% since this time last year.