Building a secondary retirement pot to complement an existing superannuation fund can have a few advantages.

Superannuation is still mightily attractive for stowing away money for future self, given its 15% tax rate. However, some limitations make a retirement vehicle separate from a super fund a practical option. This can be especially true for anyone wanting to deviate from the usual timelines and expectations surrounding retirement.

Why a second retirement fund?

In my opinion, wealth is merely a tool to do more of what you want in life (as opposed to doing what you must). Part of this freedom means spending less time working and more time living! So, it would be a logical desire to retire early with that hard-earned nest egg known as superannuation.

This is all well and good unless you enjoy some amount of work. Many of us find purpose, social connection, and a sense of achievement in our jobs. That makes it difficult for people who want to enter semi-retirement if under 60 years old.

The rule for accessing superannuation before turning the big '6-0' currently requires a person to cease work entirely with no intention of putting the boots back on. Instead, a secondary retirement fund would accommodate part-time work with no restrictions.

Which stocks would I buy?

The stocks befitting of a retirement fund will differ from person to person; there's no one-size-fits-all solution. However, as someone effectively constructing their own retirement 2.0 fund, here's my approach.

My investments are approximately a 50-50 split between individual stock picks and managed funds. This suits my risk appetite, ensuring I lose no sleep.

The managed funds portion of my portfolio sits across two micro-investing apps. However, I intend to soon move these funds into three exchange-traded funds (ETFs): Vanguard Msci Index International Shares ETF (ASX: VGS), Vaneck Morningstar Wide Moat ETF (ASX: MOAT), and Betashares Nasdaq 100 ETF (ASX: NDQ).

I look for investments that can deliver compounded growth into the future. Rather than optimising for maximum yield, my investment strategy centres around locating the largest total shareholder return (capital growth plus dividends).

The last thing anyone wants in retirement is a dividend trap.

How much is needed for early retirement?

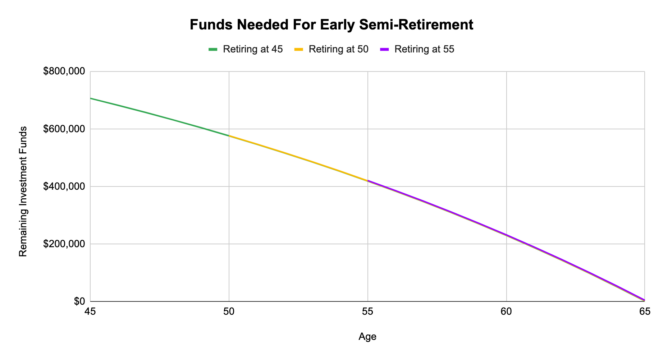

Now comes the all-important question of 'how much?'. It depends on the strategy applied, but let's assume we're using the funds until we can use our superannuation at 65 and still choose to work if we want.

According to the Australian Retirement Trust, an income of $51,000 per year is considered 'comfortable' for a single person between 65 and 84.

Assuming the same amount is adequate for a younger demographic, a $1,275,000 portfolio would be needed to generate $51,000 each year based on a 4% dividend yield.

Alternatively, the principal amount could be sold to supplement each year's dividend income. This second scenario would require far fewer funds, so let's calculate the necessary retirement fund size if this approach was taken.

Retiring at 55 years old: A second investment fund of $455,000, returning 3.8% in dividends and 6% capital growth per annum, could provide $51,000 (before taxes) through annual sell downs until reaching 65 years old.

Retiring at 50 years old: To semi-retire five years earlier, a person would need a retirement fund of $605,000 based on the same assumptions as above.

Retiring at 45 years old: A whole 20 years out from 65, an individual would need to have accumulated $730,000 in investments to pay out $51,000 annually.