Alumina Ltd (ASX: AWC) shares are off to the races today.

The S&P/ASX 200 Index (ASX: XJO) resources company closed on Friday trading for $1.02. At the time of writing on late Monday morning, shares are changing hands for $1.10 apiece, up 7.6%.

For some context, the ASX 200 is up 0.5% at this same time.

This comes amid news of a $3.3 billion takeover bid from its joint venture partner Alcoa Corp (NYSE: AA). Alumina owns some 40% of Alcoa World Alumina & Chemicals (AWWC) through the joint venture.

Here's what we know.

Alumina shares rocket on takeover offer

Alumina shares are soaring after the company confirmed it has received a non-binding, indicative and conditional proposal from Alcoa to acquire 100% of its stock via a scheme of arrangement.

Alcoa is offering 0.02854 shares of its common stock for each Alumina share.

This represents a 13.1% premium to the share price of Alumina on Friday, 23 February. And it implies a 19.5% premium based on the average exchange ratio over the last 12 months.

Alcoa's bid comes after earlier indicative offers and a period of negotiation. The US resources giant now has a 20-business day period of exclusivity.

Subject to standard conditions and the lack of a superior proposal, the Alumina board and CEO Mike Ferraro said they intend to recommend shareholders vote in favour of the takeover offer.

Alcoa noted that it's entered into an agreement with Allan Gray Australia giving the company the right to acquire up to 19.9% of Alumina for 0.02854 Alcoa shares for each Alumina share.

Commenting on the acquisition proposal, Alcoa CEO William Oplinger said (quoted by Bloomberg):

We recognise the value creation opportunities possible under a simplified ownership structure, including the ability to implement AWAC's operational and strategic decisions on an accelerated basis. We believe now is the right time to consolidate ownership in AWAC.

How has Alumina stock been tracking?

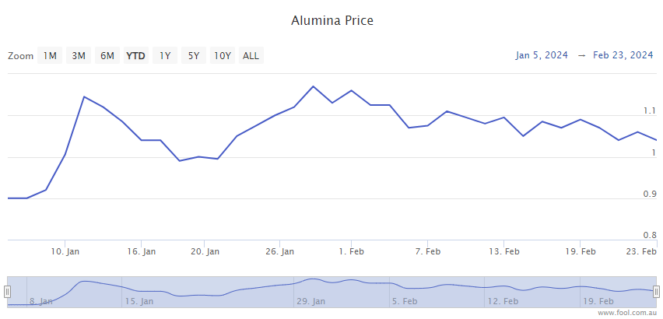

2024 has been a rewarding year for Alumina shareholders to date, with the stock now up 18% since the opening bell on 2 January.