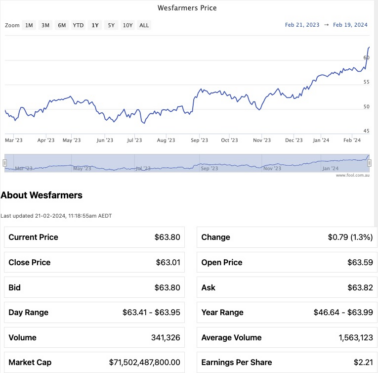

Shares for conglomerate Wesfarmers Ltd (ASX: WES) largely went sideways for all of this year, until about a week ago.

Over the past eight days, the stock has risen 9%.

So is this a buy signal? Are other investors aware of something you're not?

Let's see what's going on:

Why has the Wesfarmers share price risen?

There seem to be a couple of reasons for the recent arousal in the Wesfarmers share price.

First is that the market received the company's half-year results positively last week.

The Motley Fool's James Mickleboro reported that Wesfarmers' net profit after tax was up 3% to $1.4 billion despite tough conditions for the retail sector.

"This was driven largely by the Kmart Group business, which posted a 26.5% increase in earnings for the six months.

"Management advised that its record result reflects the positive customer response to Kmart's lowest price positioning."

The second factor was the announcement that it would pay out a 91 cent dividend, which is the largest seen since April 2019.

Is it too late to buy?

So that's all fantastic, but is it still worth buying Wesfarmers this late?

Opinion among the professional community is mixed.

According to broking platform CMC Invest, only two out of 17 analysts currently rate Wesfarmers shares as a buy.

A majority of 10 professionals recommend a hold, while five are urging investors to sell out.

So the answer to those considering buying Wesfarmers shares is… probably not.

Perhaps the recent price rise has made it even less attractive.

After all, if you go back to June 2022, the Wesfarmers share price has amazingly rocketed 55%. That's during a period when the Reserve Bank put interest rates up 13 times.

However, The Motley Fool's Sebastian Bowen is one that doesn't mind committing to the conglomerate now with a long-term horizon.

"Wesfarmers is a holding that I've been hoping to add to for a while now and just might after the company's latest earnings.

"Given the rising cost of living and stubborn interest rates, I think this is a great result for a company that would traditionally be described as cyclical and discretionary."