The Westpac Banking Corp (ASX: WBC) share price is one to watch today following the release of the bank's first-quarter update for the three months ending 31 December.

The S&P/ASX 200 Index (ASX: XJO) bank stock closed on Friday trading for $24.57 a share.

Here's what the big four bank just reported.

Westpac share price on watch as net interest margins shrink

- Unaudited net profit of $1.5 billion, down 6% from the 2H 2023 average

- Unaudited net profit excluding notable items of $1.8 billion, in line with 2H 2023

- Core net interest margin (NIM) of 1.80%, down 0.04% from 2H 2023

- Common Equity Tier 1 (CET1) capital ratio of 12.3%, down 0.09% from September 2023

What else happened with Westpac during the quarter?

The 6% drop in net profit for the quarter may not have a material impact on the Westpac share price today, with the bank noting the decline was due to notable items that exclusively related to hedge accounting which, management noted "will reverse over time".

Westpac's pre-provision increased by 1% over the three months. Revenue and expenses were both up by 2% over the period. The increased expenses were fuelled by higher amortisation expenses and ongoing inflationary pressures.

The 0.04% drop in NIM was predominantly driven by ongoing mortgage competition among the Aussie banks. While the bank said the 0.09% fall in the CET1 ratio reflected the second half dividend payment "more than offsetting earnings for the quarter".

Credit impairment provisions of $5.1 billion as at 31 December came in $1.5 billion above the expected losses of Westpac's base case scenario.

The big four bank has completed 31% of the $1.5 billion on market share buyback it announced in November.

What did management say?

Commenting on the results that could move the Westpac share price today, CEO Peter King said:

I'm pleased with our efforts to strengthen the Westpac franchise. Our Consumer NPS [net promoter score] has increased reflecting improved mortgage servicing capability and Westpac Institutional Bank's rankings across key industry surveys are higher.

From a credit quality perspective, we saw a reduction in business stress while a rise in 90+ day mortgage delinquencies reflects the tougher economic environment.

What's next?

Looking to what could impact the Westpac share price in the months ahead, King added:

We expect the economy to remain resilient, supported by low unemployment and healthy corporate sector balance sheets. The economic slowdown, combined with abating inflationary pressures, should provide scope for monetary policy to become less restrictive within the next year.

We continue to prioritise financial strength with capital, funding and liquidity well above regulatory minimums. Risk management remains a priority.

Following the completion of 100% of CORE [customer outcomes and risk excellence] program activities, we have commenced the transition period which will continue throughout 2024.

Westpac share price snapshot

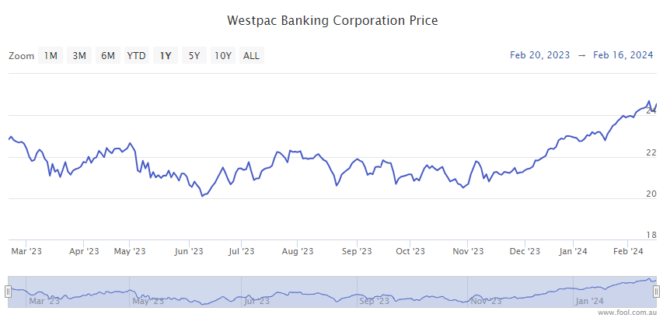

The Westpac share price is up 7% in 12 months.

Shares the ASX 200 bank stock have gained 20% since the recent October lows.