The South32 Limited (ASX: S32) share price is in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) diversified mining stock closed yesterday trading for $3.08. At the time of writing late Thursday morning, shares are swapping hands for $3.11, up 0.8%.

For some context, the ASX 200 is up 0.5% at this same time.

This comes as investors digest the company's half-year results for the six months ending 31 December (H1 FY 2024), as well as a major project announcement.

Here are the highlights.

(*Note, all figures in US dollars.)

South32 share price lifts despite profit dive

- Underlying revenue of $3.88 billion, down 14% from H1 FY 2023

- Profit after tax of $53 million, down 92% from the $685 million after tax profit in the prior corresponding period

- Underlying earnings down 93% year on year to $40 million

- Interim fully franked dividend of 0.4 US cents per share, compared to the prior interim dividend of 7.3 Aussie cents per share

What else is happening with the ASX 200 miner?

In other metrics that could impact the South32 share price, the company reported underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) of US$708 million.

Management noted that despite record aluminium production over the six months, underlying EBITDA was down 48% year on year due to lower commodity prices as well as lower volumes of its metallurgical coal. Coal production was impacted as the ASX 200 miner completed planned longwall moves at its Illawarra Metallurgical Coal asset.

Pleasingly for passive income investors, South32 returned US$180 million to its shareholders over the six months. That included US$145 million in dividends and a US$35 million on-market share buyback.

On the cost front, the miner's focus on efficiencies and options to defer non-critical projects has seen it lower or maintain its FY 2024 operating unit cost guidance across most operations.

South32 share price boosted by US$2.2 billion project approval

In big news today, the South32 share price looks to be shaking off the plunge in profits after the company announced it has approved a final investment decision (FID) to develop the Taylor zinc-lead-silver deposit at its Hermosa project in the US state of Arizona.

What did management say?

Commenting on the Hermosa FID that appears to be offering some tailwinds for the South32 share price today, CEO Graham Kerr said:

We have taken the next step in our portfolio transformation by announcing a US$2.16 billion investment in the Taylor zinc-lead-silver deposit at our Hermosa project in Arizona, with first production expected in H2 FY 2027.

This investment is a major milestone for our business, that further reshapes our portfolio towards commodities critical to a low-carbon future. Taylor is expected to deliver value for shareholders for decades to come and underpin further growth phases at our regional scale Hermosa project, establishing it as a globally significant producer of commodities critical for a low-carbon future.

What's next for South32?

Looking at what could impact the South32 share price in the months ahead, the company maintained its FY 2024 production guidance. The miner expects to deliver a 7% increase in production volumes in the current half-year.

Kerr added the miner will also "remain focused on driving operating performance and cost efficiencies across" its business.

South32 share price snapshot

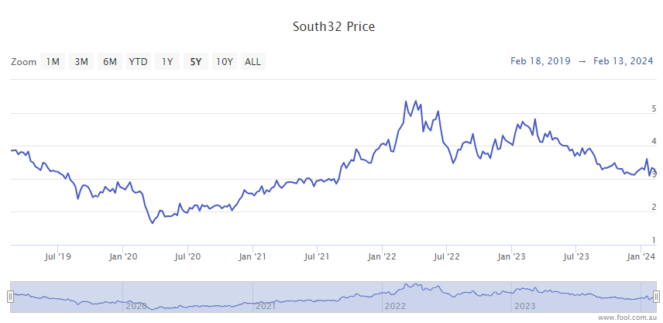

The South32 share price has struggled over the past 12 months, down 32%.