Passive income investors take note, this ASX All Ords stock just boosted its dividend by more than 33%.

The big lift in the interim dividend, driven by strong H1 FY 2024 results, looks to be helping the company outperform the broader market today.

In late morning trade on Wednesday, the All Ordinaries Index (ASX: XAO) is down 1.2%, while this ASX All Ords stock is up 3.4%, trading for $25.90 a share.

Any guesses?

If you said Computershare Ltd (ASX: CPU) give yourself a virtual gold star.

Shares in the administration services company are charging higher today following on Computershare's half-year results, released after market close yesterday.

Here are the highlights.

ASX All Ords stock supersizes its dividend

- Half-year management revenue increased 6.2% year on year to $1.6 billion

- Margin income increased by 24.8% to a record $429.4 million

- Management earnings before interest and tax (EBIT) excluding margin income increased 20.7% to $116.5 million

- Interim dividend of 40 cents per share, 20% franked, up 33.3% from H1 FY 2023

Atop the passive income boost what else happened during the half year?

Passive income investors looking to score the boosted dividend from this ASX All Ords stock will need to own shares at market close next Monday, 19 February. Computershare trades ex-dividend on Tuesday.

Management noted that with debt leverage down to 0.85 times, the company's strong balance sheet supported the big dividend increase, along with the ongoing share buyback and disciplined M&A.

The company cited tailwinds over the six months including growth in recurring fee revenues and recovery in some of its events and transactional revenues. Higher yields and stable client balances delivered the record half-year margin income.

What did management say?

Commenting on the results that are boosting the ASX All Ords stock today, Computershare CEO Stuart Irving said:

We are making good progress executing on our strategies to invest in and strengthen our core businesses and divest non-core assets. We are building a simpler Computershare with stronger and more consistent returns.

In October, we successfully completed the transition of the Corporate Trust (CCT) business we acquired from Wells Fargo. Now the technology and operating environment are in our control we can get on with realising the full planned synergies and integration benefits.

What's next for Computershare?

Looking at what could impact the ASX All Ords share in the months ahead, Irving said the sale of its United States Mortgage Servicing business was "progressing well and is due to close in March 2024".

He noted that internal separation activities are nearing completion, with 80% of key state and agency regulatory approvals and client consents having now been received.

The company also reaffirmed its FY 2024 guidance of a roughly 7.5% increase in management earnings per share (EPS) to around $1.16 cents per share.

Computer share expects second-half EPS to be more than 11% higher than the first half. That could bode well for the passive income outlook for 2H.

Irving elaborated:

Margin income is expected to be around $825 million, with the levels of interest rates and balances being our largest earnings sensitivities. Guidance does not include the benefit of the share buyback.

We also assume we retain US Mortgage Services for the full six months of 2H, although we expect to close the transaction in March. The sale is expected to be earnings neutral this year and we will update investors on completion.

How has this ASX All Ords stock been tracking?

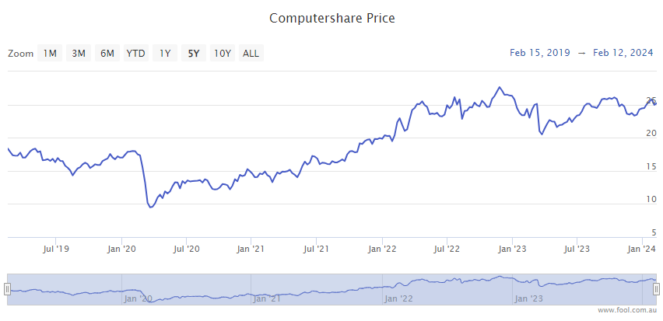

The Computershare share price has gained 6% over the past 12 months, not including the dividend payouts.

The ASX All Ords stock is up 26% since last year's 21 March lows.