You don't need to be a millionaire to start earning a meaningful annual passive income stream.

In fact, by investing just $833 a month in ASX shares, you could create a passive income of $845 a year, or more, in only 12 months' time.

Now, there are a wide number of quality S&P/ASX 200 Index (ASX: XJO) dividend stocks that could help you achieve this goal. But, keeping in mind the importance of diversification, you wouldn't want to invest all of your money into a single, high-yielding company.

Even quality companies with a good track record of annual dividend payouts can run into short-term troubles that could slash the passive income you were expecting to bank.

However, as you may have noticed in the title, I did mention one particular ASX share.

Here's why.

This ASX ETF is a passive income leader

The ASX share in question is the BetaShares Australian Dividend Harvester Fund (ASX: HVST).

The appealing thing for passive income hunters is that this exchange-traded fund (ETF) gives investors instant diversity through its portfolio of 40 to 60 high-yielding, blue-chip ASX shares.

As of the end of December, the ETF's top three holdings are Commonwealth Bank of Australia (ASX: CBA) BHP Group Ltd (ASX: BHP) and CSL Limited (ASX: CSL).

And HVST pays out dividends on a monthly basis, meaning your next passive income payout is never too far away.

Because the ETF's holdings are actively managed and rebalanced every three months to target higher-yielding ASX dividend stocks, the annual management fee is 0.72%.

If you're looking to capture the magic of compounding so you can watch your annual income soar over the years, HVST offers a partial or full dividend reinvestment plan.

As at 31 January, the ETF had a 12-month trailing yield of 5.94%, 79.5% franked. Those franking credits bring the grossed-up yield to 8.45%.

Based on this grossed-up dividend yield alone, investing $833 a month (or $10,000 over a year) should deliver $845 in annual passive income.

Of course, we're also hoping to see the ETF deliver some share price gains in 2024.

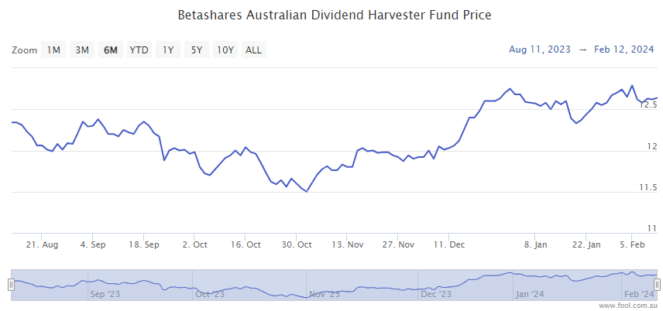

The HVST share price is down 2% since this time last year. But the ETF has gained 10% since 31 October.

If that upward trend continues, it could see this ASX ETF deliver significantly more than $845 in passive income from those 12 monthly $833 investments.