The BHP Group Ltd (ASX: BHP) share price is in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) iron ore miner closed yesterday trading for $46.07. Shares are currently changing hands for $46.36 apiece, up 0.6%.

For some context, the ASX 200 is essentially flat at this same time.

A rebounding iron ore price, up 1.2% to US$128.10 per tonne, looks to be negating any headwinds the BHP share price may be getting ahead of Friday's looming rail workers' strike action.

Here's what's happening on the labour front.

Rail workers set to halt trains

Ongoing enterprise agreement negotiations between the ASX 200 mining giant and its train drivers and rail workers in Western Australia have, as yet, failed to reach a mutually acceptable conclusion.

In an escalation that doesn't appear to be hindering the BHP share price today, this will likely see the workers in the Pilbara engage in a 24-hour stoppage on Friday, impacting the miner's iron ore export shipments to Port Hedland.

According to the Mining and Energy Union (MEU), 97% of its members voted in favour of the industrial actions.

MEU WA secretary Greg Busson said (quoted by The Australian Financial Review), "These drivers are simply seeking guaranteed conditions in a range of areas that will make a big difference to them and their families."

Busson added:

They've been very patient and given BHP every opportunity to address their concerns. Stopping the trains this Friday sends a strong message to BHP about their unity and determination.

Warren Wellbeloved, BHP general manager of rail, noted the "valued contribution" the rail workers make to BHP.

And he indicated an agreement may be within reach.

According to Wellbeloved:

We made a fair and generous offer in December 2023, but the majority of employees voted to continue bargaining. We have been listening to employee feedback on that offer and are currently reviewing a revised set of claims provided by union representatives.

BHP share price snapshot

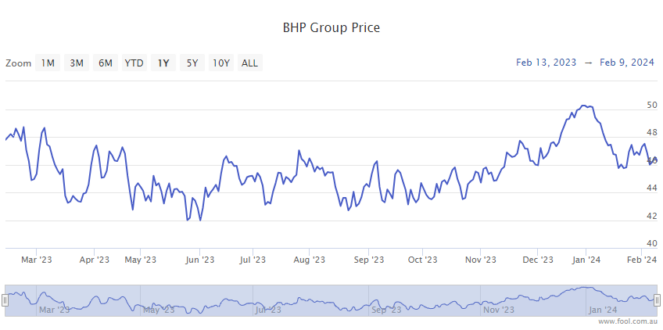

The BHP share price is down 3% since this time last year.

Shares in the ASX 200 miner have gained 7% since the recent lows on 23 October.