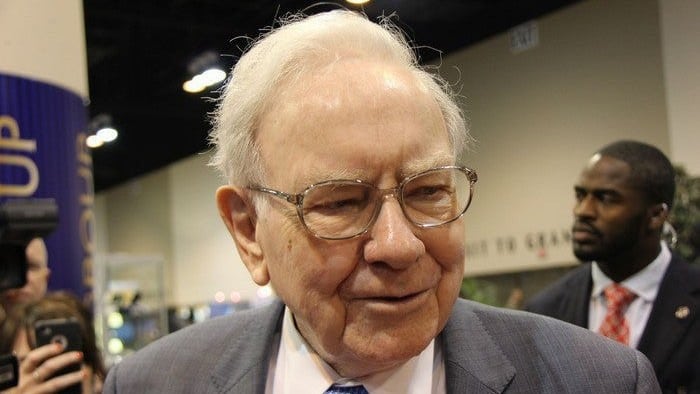

Over multiple decades, Warren Buffett's investment strategy has been hugely successful.

The Oracle of Omaha's long-term approach and investment in high-quality companies trading at fair valuations has allowed him to outperform the stock market and receive huge dividend windfalls each year.

The good news is that there's nothing to stop you from following in Buffett's footsteps, even from a starting age of 50.

In fact, by starting today, you could be generating a decent source of passive income in no time.

Passive income the Warren Buffett way

As mentioned above, one of the key parts of Warren Buffett's investment strategy is to take a long-term approach.

Buffett isn't interested in short-term fads. Instead, he seeks to maximise his returns over many years of compounding. There's a very good reason for this. It provides the Berkshire Hathaway (NYSE: BRK.B) leader with the time his investments need to deliver on their potential.

A good example of this is actually the Berkshire Hathaway share price. There's no doubting the company's quality. But if you had invested in September 2021, your investment would have been down by approximately 5% a year later. No doubt you would have been somewhat disappointed at that point.

But if you fast-forward to today, its shares have climbed approximately 50% since September 2022. Clearly it has paid to be patient.

Now imagine that you kept doing this with a diverse portfolio of high quality, dividend-paying stocks with sustainable competitive advantages, in time they would start to provide you with a growing source of passive income.

But how much?

If you are in a position to invest $1,000 per month over 15 years and generated an average annual return of 10% (and reinvested your dividends), your portfolio would grow to be worth $400,000.

At that point, you could stop reinvesting your dividends and start using them as passive income. But how much income could you generate?

With a portfolio worth $400,000 and an average dividend yield of 5%, you would be pulling in $20,000 of passive income each year.

But it won't stop there, even without any further contributions.

If your portfolio continued to grow by 5% each year after dividend redemptions, it would increase to $650,000 in 10 years. Earning a 5% dividend yield on this portfolio would mean passive income of $32,500.

It is also worth noting that by following Warren Buffett's strategy of making patient investments in high quality companies with competitive advantages, it may be possible to beat the market returns and produce a larger portfolio and an even more generous source of income.