Commonwealth Bank of Australia (ASX: CBA) stock is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $114.37. As we head into the lunch hour on Wednesday, shares are changing hands for $115.04 apiece, up 0.6%.

For some context, the ASX 200 is up 0.7% at this same time.

That's today's CBA stock price action for you.

Now, here's what's happening with Australia's biggest bank and Microsoft Corp (NASDAQ: MSFT), the world's biggest company.

Tapping into AI to boost efficiency

Microsoft, with an eye-watering market cap of US$3 trillion (AU$4.6 trillion) is a global leader in the artificial intelligence (AI) revolution.

In 2019 the company invested US$1 billion into OpenAI. And it's kept adding to its holdings since then, which sees it with a 49% stake in the start-up. That partnership has proven to be a valuable one for Microsoft, giving it prime access to some of the world's leading AI models.

And CBA stock could enjoy some longer-term tailwinds as the bank works to boost the efficiency of its staff with its own early adoption of Microsoft's AI technologies.

CBA's group chief information officer, Gavin Munroe, said the bank has rolled out Microsoft's GitHub co-pilot to its software engineering teams. He said their productivity was soaring as a result, adding that the introduction of AI-driven efficiency improvements had not directly led to any of last year's staff layoffs.

According to Munroe (quoted by The Australian Financial Review), "We tried to quantify the benefits of upgrading highly skilled engineering talent to more complex stuff, and there is a 30% uplift in just those boilerplate activities, that every engineer had to do,"

Boilerplate refers to the basic code that supports more sophisticated applications.

Munroe added:

In the last 12 weeks 80,000 lines of code have been generated by GitHub Co-Pilot, which is one-third of the lines of code created across the bank … When we asked engineers to describe the impact, they said they are being 50% more creative.

How has CBA stock been performing?

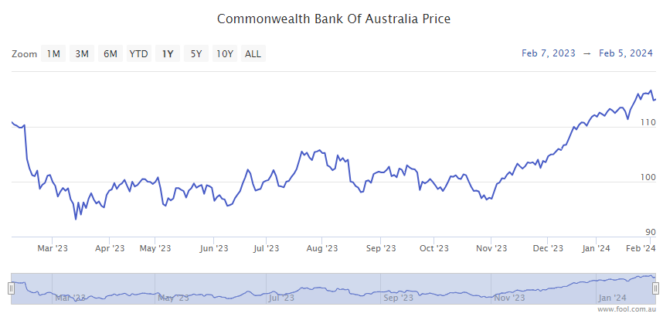

CBA stock is up 4% over 12 months.

The ASX 200 bank's shares really took off in late October. That strong run sees the CBA share price up 19% since 31 October.

And, in case you're wondering, Microsoft shares have rocketed 52% since this time last year.