There are some names in the S&P/ASX 200 Index (ASX: XJO) that used to be staples in many investor portfolios, but have fallen out of favour in recent years.

However, at least one expert reckons there's an opportunity to buy some of those for cheap right now with a long horizon to make some reasonable money.

Here are the two picks that Shaw and Partners portfolio manager James Gerrish has in mind:

Could the victim of geopolitics now become the beneficiary?

In 2020, COVID-19 seemingly had the whole world locked down without any vaccination or protection.

The Australian government then called for an independent enquiry into the origins of the pandemic.

While it was a reasonable suggestion, the Chinese Communist Party took great offence and started to place punitive economic measures against Australian businesses.

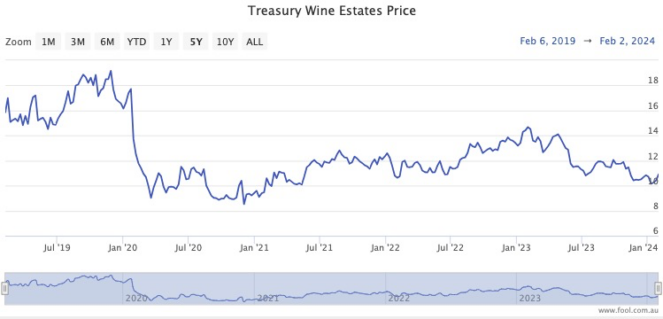

One of the biggest victims was Treasury Wine Estates Ltd (ASX: TWE), which instantly lost its biggest export market.

Four years later, the brutal fact is that the share price has still not recovered to its pre-COVID high.

However, Gerrish indicated in his Market Matters newsletter that his team was convinced the outlook looked positive from here for the winemaker.

"This week saw Wine Australia announce that Dec 23 export growth had improved significantly against the previous quarter," he said.

"Strong demand from Hong Kong was the standout, with the over-$10-a-bottle category remaining stronger than the discount end."

He pointed out that "Hong Kong is a major trading hub", so wines could be distributed to the rest of Asia from there.

Gerrish's analysts are "long and bullish" for Treasury Wine shares.

"We remain optimistic towards Treasury Wine Estates, based on our ongoing confidence in its Penfold distribution and pricing growth, plus the positive risk from the potential removal by China of duties on Australian wine, which we don't believe is reflected in the share price."

The team already holds Treasury in its active growth portfolio.

The ASX 200 healthcare outfit dispelling the doubters

Notwithstanding a recent rally, Resmed CDI (ASX: RMD) is still 12% lower than where it was in late July.

Gerrish loved the January business update.

"ResMed rallied strongly in late January after reporting better-than-expected 2Q earnings, primarily driven by better margins — a welcome relief after the stocks plunge on demand fears courtesy of Ozempic and other weight loss 'wonder drugs'."

His team already holds ResMed shares, but will continue to back it for further growth.

"The stock's strength over the last fortnight is encouraging, but we aren't tempted to cut this position even after it bounced ~38%," said Gerrish.

"We can see ResMed trading well above $30 through 2024."

ResMed closed Monday at $29.53.