Can you believe it's February already? 2024 feels like it only just started.

This week will be huge for the direction of ASX shares and financial markets. Here are the biggest events to keep an eye on, according to eToro market analyst Josh Gilbert:

1. Australian reporting season

Reporting season in the United States — or 'earnings season', as the Yanks call it — is already well under way, but this week sees many big Australian names reveal their latest numbers.

"Australia's reporting season will step up a notch with big names such as AGL Energy Limited (ASX: AGL), Mirvac Group (ASX: MGR) and Transurban Group (ASX: TCL) all releasing half-year results," said Gilbert.

"Earnings growth for the S&P/ASX 200 Index (ASX: XJO) looks to be modest at around 3.4% for the first half of the financial year, and expectations will be high with the market sitting at record levels."

He added that the market would be focused on "margins and cost control".

"Given China's economy is still not playing ball, miners will be in focus throughout the reporting season, especially with lithium prices continuing to free fall and the materials sector's strong end to the year."

The real estate sector was the best performer on the ASX in the final quarter of 2023.

"With [potential] rate cuts driving these stocks high, expectations will be high, and investors won't want to be disappointed."

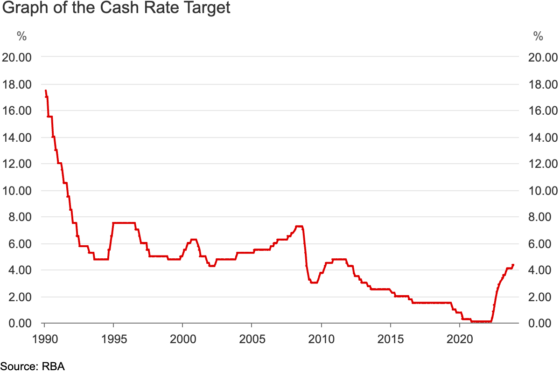

2. Interest rate decision

The Reserve Bank board is back in action Tuesday after its January break.

According to Gilbert, the market has fully priced in a "no change" in interest rates this month, courtesy of plunging retail sales and favourable unemployment and Q4 inflation data.

"It's all but guaranteed now that, barring a massive unforeseen economic event, the RBA is done with their hiking cycle.

"The possibility of cuts is still months away, but recent data now points towards the potential of seeing three cuts in 2024, up from the two anticipated at the start of the year and the first cut very much on the table in June."

Rather than the rate decision itself, the bigger interest is what RBA governor Michele Bullock has to say at the new post-board meeting press conference.

Even though the central bank will want to stamp out inflation, which is still too high, the recent economic data could make it hard for her to choose her words.

"It may be difficult for Governor Bullock to sway away from sounding dovish.

"All of this is good news for the local market, with just one losing day in the last ten taking the ASX 200 to record highs."

3. China inflation

The world's second largest economy and Australia's biggest trading partner continues to struggle with deflation.

"China's CPI fell 0.5% in November – the sharpest decline in two years – and while Thursday's CPI results aren't likely to be as dramatic, markets are expecting the trend to continue falling for a fourth straight month with a 0.3% decline anticipated."

The real estate sector, which had been for so long the engine of China's economic rise, is in serious trouble with giant company Evergrande ordered into liquidation last week.

"More governmental reform seems all but guaranteed now, but sluggish movement here, as well as a delay in scheduling the third promised economic plenum, means investors don't have much to look forward to yet."

China's woes have an adverse impact on ASX shares.

"The nation's post-pandemic recovery has been anything but effective, with growth slowing and its ripple effect will likely continue to harm Australia's export industries."