Woodside Energy Group Ltd (ASX: WDS) shares are joining in the broader market sell-down today.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock could be facing some additional pressure from a 1.4% overnight drop in the Brent crude oil price. Brent slid to US$81.72 per barrel, amid news of swelling crude production in the United States.

Woodside shares closed yesterday trading for $32.41. In afternoon trade on Thursday, shares are swapping hands for $32.09 apiece, down 1%.

The ASX 200 is also down 1% at this same time.

That's the latest price action for you.

Now, here's why Woodside shares are making news this week.

What's putting Woodside shares in the news

In an Australian first, Woodside announced that it has joined the United Nations Environment Programme (UNEP) Oil & Gas Methane Partnership 2.0 (OGMP 2.0).

The program provides a measurement-based reporting framework to help improve the accuracy and transparency of methane emission reporting.

Oil and gas production comes with significant methane emissions, which has previously seen Woodside shares targeted by activists.

Commenting on the development, Woodside CEO Meg O'Neill said, "Woodside is pleased to extend our leadership in minimising methane emissions by being OGMP 2.0's first Australian member. "

She added that, "As part of our methane strategy, Woodside is striving for near-zero methane emissions on operated assets by 2030."

OGMP 2.0 program manager, Giulia Ferrini said, "We are thrilled to welcome Woodside to the Partnership as its first member company in Australia."

According to Ferrini:

This is a valuable step towards expanding methane accountability and transparency across the industry and the region. As customers, investors and governments demand stronger methane performance, we hope Woodside's commitment will inspire others to join OGMP 2.0 and adopt a high standard of emissions reporting and management.

Woodside said it has four key pillars to its methane reduction plan:

- Developing a high-integrity measured dataset

- Striving for near-zero methane emissions

- Transparent reporting

- Leadership through advocating and collaborating with others

The company noted its 2022 methane emissions were "around 0.1% of our production by volume, well below the Oil and Gas Climate Initiative (OGCI) methane intensity target of below 0.2%".

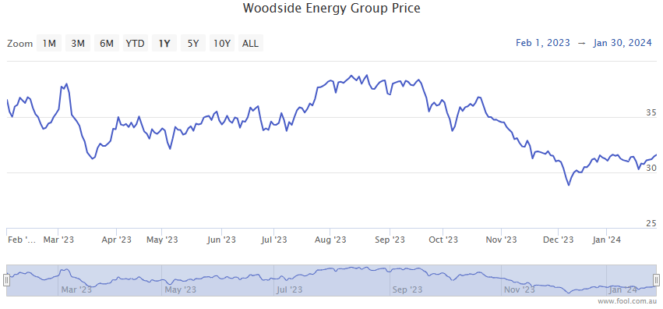

Woodside shares are down 10% over the past 12 months and up 2% so far in 2024.