Investors looking for dependable passive income in 2024 may wish to run their slide rules over these two quality S&P/ASX 200 Index (ASX: XJO) dividend shares.

Both companies have long track records of paying two (or more, on rare occasion) fully franked dividends a year. Even during the pandemic-addled times in 2020.

Both have seen their share prices rise significantly over the past year. And both offer very solid yields.

Which ASX 200 dividend shares am I talking about?

I'm glad you asked!

Mining passive income from the iron ore boom

The first quality ASX 200 dividend share to investigate for passive income in 2024 is iron ore mining giant Fortescue Metals Group Ltd (ASX: FMG).

Over the past 12 months, Fortescue paid an interim dividend of 75 cents a share on 29 March, followed by a final dividend of $1.00 a share paid to eligible investors on 28 September.

That equates to a full-year passive income payout of $1.75 a share.

At the recent Fortescue share price of $29.60, that sees this ASX 200 dividend share trading at a fully franked trailing yield of 5.9%.

Now, Fortescue's 2023 dividends were down a bit from 2022, and significantly lower than 2021, amid a retrace in the iron ore price from the 2021 highs.

But the industrial metal, Fortescue's top revenue earner, has been gaining since late May last year when it was trading for just under US$100 per tonne.

Iron ore was trading for a bit over US$133 per tonne yesterday. And, according to the analysts at Citi, iron ore should hit US$150 per tonne during the first three months of 2024.

That's largely thanks to a ramp-up in stimulus measures from the Chinese government to rekindle the country's struggling, steel-hungry property markets.

With that in mind, this is one reliable ASX 200 dividend share passive income investors may wish to add to their portfolios.

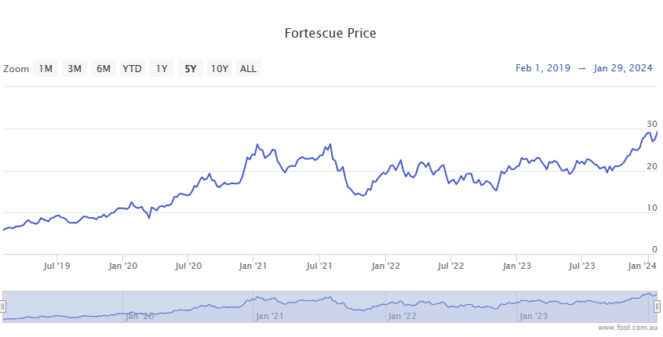

The Fortescue share price is up 33% since this time last year.

A rock-solid ASX 200 dividend share

Commonwealth Bank of Australia (ASX: CBA) is Australia's largest bank stock and the second biggest company listed on the ASX.

The passive income payments from this ASX 200 dividend share have been remarkably stable over the past 10 years. That's with the sole exception of the second half of 2020 when COVID-19 saw the final dividend cut roughly in half.

CBA's final dividend of 2023, paid on 28 September, set a new all-time high. CBA also delivered an interim dividend of $2.10 a share on 30 March.

This works out to a full-year passive income payout of $4.50 per share.

At the recent CBA share price of $117.64, that sees this ASX 200 dividend share offering a fully franked 3.8%.

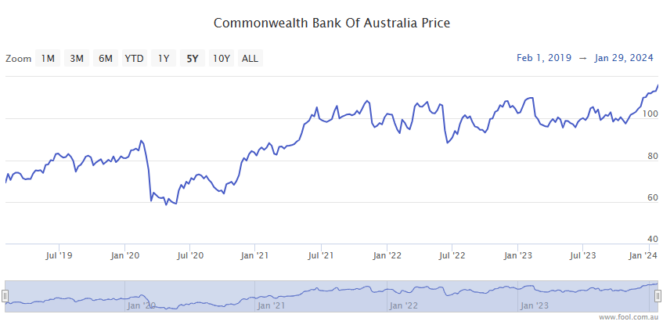

The CBA share price is up 7% over the past 12 months.