The Netwealth Group Ltd (ASX: NWL) share price is on a bit of a rollercoaster today.

Shares in the S&P/ASX 200 Index (ASX: XJO) investment platform provider were up 2.5% in early trade on Monday. In later morning trade, shares have given up those gains.

After dipping into the red, the Netwealth share price is up 0.6%, at $17.48 at the time of writing.

For some context, the ASX 200 is up 0.2% at this same time.

This follows the release of Netwealth's quarterly update for the three months ending 31 December.

Read on for the highlights.

ASX 200 investors gauging record funds increase

The Netwealth share price is in the green after the company reported a $6.0 billion increase in its funds under administration (FUA) over the quarter. That's 25% higher than the prior corresponding period.

As at 31 December, Netwealth reported FUA of $78.0 billion.

The three-month increase consisted of FUA net inflows of $2.6 billion and "positive market movement" of $3.4 billion.

The Netwealth share price was a strong performer in 2023, fuelled by record 12-month FUA inflows of $19.7 billion.

In other key metrics, the company's funds under management (FUM) increased by $1.6 billion for the quarter. Netwealth saw FUM net inflows of $700 million over the three months.

The company's Managed Account balance also saw a big boost, up $1.3 billion for the quarter to $15.5 billion.

And member accounts grew by 3,254 to reach 132,826 accounts as at 31 December.

Commenting on the improved performance, management said:

In recent quarters, we have reported elevated outflows which were, in part, due to clients investing in term deposits and fixed interest products off platform. To improve the client experience and retention of assets on the platform, we delivered a number of initiatives including new functionality and an increased range of fixed income products.

These initiatives (when combined with stronger equity markets), appear to have been effective, with FUA outflows beginning to decrease and the December month being the lowest since February.

Looking ahead, Netwealth reported it is seeing increased demand from clients for environmental, social and corporate governance (ESG) and responsible options.

The company also noted it was actively exploring tapping into the rapid rise of generative AI to "improve efficiency, productivity, client engagement and service".

Netwealth share price snapshot

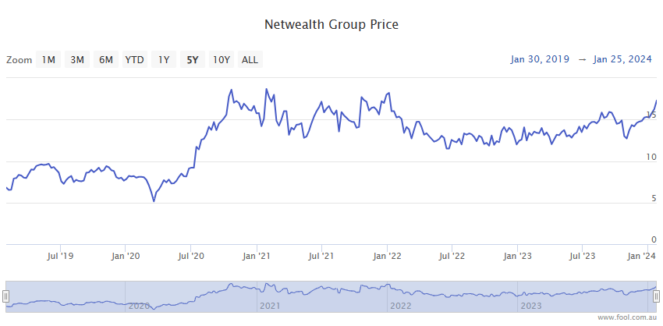

The Netwealth share price has gained 32% over the past 12 months.

ASX 200 investors who bought shares on 26 October will be sitting on gains of 40%.