The Mineral Resources Ltd (ASX: MIN) share price is soaring higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock and diversified resources producer closed yesterday trading for $55.47. At the time of writing on Thursday morning, shares are swapping hands for $59.45 apiece, up 7.2%.

For some context, the ASX 200 is up 0.3% at this same time.

This comes following the release of Mineral Resources' quarterly update for the three months ending 31 December.

Here are the highlights.

Mineral Resources share price lifts on profitable lithium outlook

Investors are bidding up the Mineral Resources share price after the ASX 200 miner reported improvements across most of its operating segments.

For the Mining Services division, the company reported a 9% quarter on quarter increase in production volumes to 72 million tonnes (Mt).

Mineral Resources iron ore shipments were also up 23% from the prior quarter, at 4.8 million wet metric tonnes (wmt). The miner received an average quarterly price of US$119 per dry metric tonne (dmt).

Management said that the company's Onslow Iron project in Western Australia "is progressing at pace and expected to be delivered well within budget". Mineral Resources is aiming for its first ore-on-ship from the project in June.

And the company noted that it "expects to introduce a partner to own a 49% interest in the Onslow Iron dedicated haul road this half to coincide with first ore on ship."

As for its energy segment, gas drilling commenced over the quarter at Mineral Resources' Lockyer-5 project in WA. This is expected to be developed as one of 10 production wells. Management plans to make a Final Investment Decision (FID) on the gas processing facility this quarter.

On the lithium front, ASX 200 investors may be bidding up the Mineral Resources share price after the company said that its Wodgina, Mt Marion and Bald Hill assets are all profitable at current lithium prices. That's despite the massive fall in lithium prices over the past year.

Management forecasts that costs at Wodgina and Mt Marion will fall this year as stripping completes. They also noted that Wodgina lithium battery chemical production came in at 6,800 tonnes, with sales up 52% quarter on quarter to 6,500 tonnes.

The quarter also saw the ASX 200 miner finalise its acquisition of Bald Hill, assuming project control on 1 November 2023, which could offer a boost to the Mineral Resources share price over the longer term.

"Over this period, the mine produced 26k dmt of spodumene concentrate, with 20k dmt shipped," according to the miner.

As for the balance sheet

The three months saw Mineral Resources complete a five-year US$1.1 billion Senior Unsecured Notes Offering at 9.25%. Management expects H1 2024 net debt to be between $3.47 billion and $3.61 billion.

FY 2024 volume and cost guidance remained unchanged for all its operations.

Mineral Resources share price snapshot

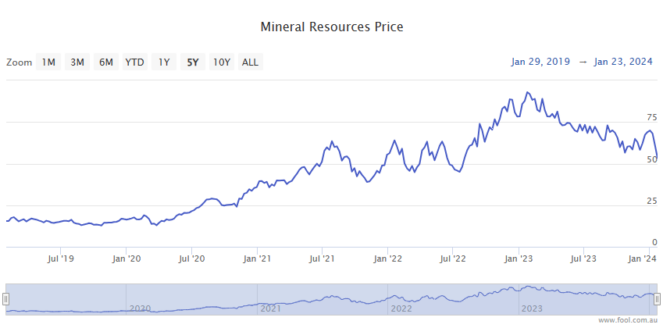

Despite today's welcome lift, the Mineral Resources share price has some more lost ground to make up, with shares down 37% over the past 12 months.