The Fortescue Metals Group Ltd (ASX: FMG) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining stock closed yesterday trading for $28.39. In morning trade on Thursday, shares are swapping hands for $29.01 apiece, up 2.2%.

For some context, the ASX 200 is up 0.4% at this same time.

Atop another 2.4% overnight lift in the iron ore price to US$135.15 per tonne, the Fortescue share price looks to be getting a boost from the company's quarterly update for the three months to 31 December (Q2 FY 2024).

Fortescue share price gains on near-record iron ore shipments

The Fortescue share price is in the green today after the company reported 48.7 million tonnes (Mt) of iron ore shipments for the quarter.

This brought iron ore shipments to 94.6Mt for the first half of the 2024 financial year (H1 FY 2024). That's the second highest first half-year shipment in the ASX 200 miner's history.

Fortescue reported it received an average revenue of US$116/dry metric tonne (dmt) for its Pilbara Hematite (higher grade iron ore).

On the cost front, the miner's Pilbara Hematite C1 cost (direct cost) was US$17.62/wet metric tonne (wmt) over the three months. This could be offering some tailwinds for the Fortescue share price, as C1 costs were 2% less than the prior quarter.

Other highlights of the quarter included the launch of Fortescue Capital, a green energy investment accelerator platform, which is headquartered in New York City.

And the ASX 200 miner shipped its first product from the Belinga Iron Ore Project in Gabon. That marked the first time Fortescue has exported iron ore from any port outside of Australia.

Turning to the balance sheet, Fortescue's cash balance was US$4.7 billion at 31 December 2023. That's up from US$3.1 billion at 30 September 2023.

Total capital expenditure and investments for the quarter came in at US$759 million, bringing total capital expenditure and investments for H1 FY 2024 to US$1.5 billion.

Net debt fell to US$600 million from US$2.2 billion on 30 September 2023.

What did management say?

Commenting on the results that look to be supporting the Fortescue share price today, CEO Dino Otranto said:

We continue to deliver strong operational performance while making tangible progress towards our ambitious decarbonisation and green energy targets…

Demand for Fortescue's suite of iron ore products remains strong and our entry into the higher-grade segment of the market through Iron Bridge has been well received with our second magnetite shipment during the quarter…

Our energy business marked a significant milestone, with final investment decisions announced for green hydrogen projects in Australia and the USA.

What's ahead for the ASX 200 miner?

Looking at what could impact the Fortescue share price in the months ahead, the ASX 200 miner maintained its guidance for FY 2024 total shipments of 192Mt to 197Mt.

It expects C1 cost for Pilbara Hematite of US$18 to US$19/wmt, slightly higher than the quarter just past.

Metals capital expenditure is forecast to be in the range of US$2.8 billion to US$3.2 billion.

And Fortescue forecasts energy net operating expenditure of around US$800 million, with capital expenditure and investments of some US$500 million.

Fortescue share price snapshot

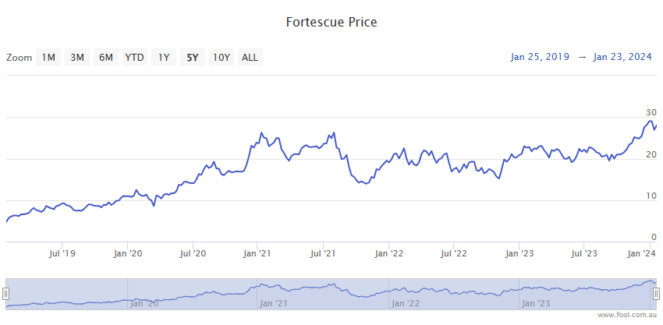

With today's lift factored in, the Fortescue share price is up an impressive 29% over the past 12 months.

Shares have gained 31% over the past three months.