The Lynas Rare Earths Ltd (ASX: LYC) share price is in the red today.

Shares in the S&P/ASX 200 Index (ASX: XJO) rare earths miner closed Friday trading for $5.95. In morning trade on Monday, shares are swapping hands for $5.84 apiece, down 1.9%.

For some context, the ASX 200 is up 0.5% at this same time.

This comes following the release of Lynas' quarterly update for the three months ending 31 December (Q2 FY 2024).

Here are the highlights.

Lynas share price hit by falling production

The Lynas share price is sliding after the miner reported a 40% year on year fall in rare earths production.

Over the three months Lynas produced 901 tonnes of neodymium and praseodymium (NdPr), down from 1,508 tonnes in Q2 FY 2023.

Total rare earth oxide (REO) production during the quarter came in at 1,566 tonnes, down from 4,457 tonnes in the prior corresponding period.

Investors could also be pressuring the Lynas share price today with quarterly sales revenue coming in at $113 million, down from $233 million year on year. Lynas reported sales receipts of $107 million, down from $168 million in Q2 FY 2023.

However, management noted this slowdown was due to a temporary shutdown for upgrade works at its Lynas Malaysia facility, with production forecast to ramp back up over the coming quarters.

"During the shutdown, the works to modify and increase separation capacity and improve the reliability of cracking and leaching at Lynas Malaysia were successfully and safely completed," the miner stated.

Lynas now expects production in the March quarter to be around 1,500 tonnes. Production across the six months to June 2024 is forecast to increase slightly from its previous guidance to be in the range of 3,200 to 3,400 tonnes.

NdPr production capacity is expected to increase to approximately 10,500 tonnes a year by December 2024.

The three months also saw Lynas receive a variation for its Lynas Malaysia's operating licence from the Malaysian government, a variation which boosted the Lynas share price at the time.

This now allows the ASX 200 miner to keep importing and processing Lanthanide Concentrate from its Mt Weld mine in Western Australia. The amended operating licence is valid until 2 March 2026.

As for the balance sheet, as at 31 December, Lynas held cash and short-term deposits of $686 million.

In other news relating to the current quarter, Lynas also reported on the successful completion of its exploratory drilling program at Mt Weld.

Lynas share price snapshot

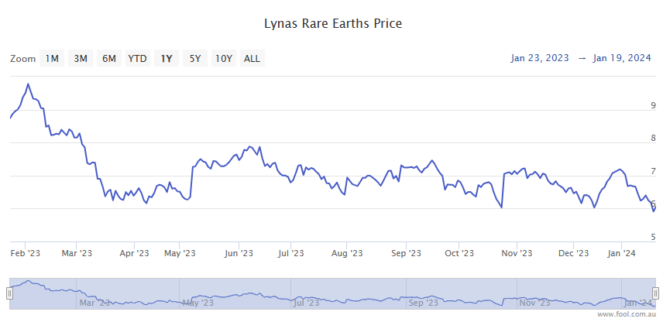

The Lynas share price has struggled over the past year, down 34%.

Shares remain up 33% over three years.