ASX shares that grow their dividend payouts when possible are very attractive as they can give a degree of protection against headwinds.

There's no guarantee a company will increase its dividend payment. It's dependent on the business making — and hopefully growing — a profit. Ultimately, the board of directors decides on the level of a company's dividend payment, taking balance sheet strength and the overall outlook into consideration.

Having said all of that, I believe the following three ASX shares are likely to grow their dividends this year.

APA Group (ASX: APA)

APA is one of the largest infrastructure businesses on the ASX. Its key asset is large natural gas pipelines around Australia, connecting supply to demand markets. It transports half of the country's usage.

The energy company also has other assets – gas processing facilities, gas storage, renewable energy generation and electricity transmission.

APA has grown its dividend every year since 2004, so it has almost two decades of continuous payout growth for shareholders.

FY24 isn't expected to see a big payout increase, but it is guided (by APA) to be bigger. APA pays for its distribution by its growing cash flow. Recent inflation has delivered a helpful boost to its revenue.

In FY24, the dividend is expected to increase slightly to 56 cents per security. This is a forward distribution yield of 6.8%.

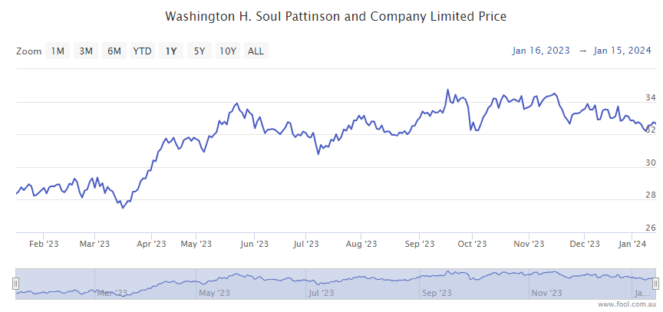

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL)

Commonly known as Soul Patts, this ASX share owns a diversified portfolio of assets across telecommunications, property, financial services, resources, agriculture, credit, swimming schools and so on.

The business receives investment income from its asset portfolio (which hopefully grows its payouts each year to Soul Patts). The ASX share pays for its expenses from that investment cash flow. It then pays a majority of the net cash flow to investors as a growing dividend and re-invests the remaining cash.

Soul Patts hasn't given any particular dividend guidance, but it has increased its annual ordinary dividend every year since 2000. Growing the dividend is one of the main aims of the management team, along with building the value of the portfolio.

I think this business is one of the most likely to grow its dividend in 2024.

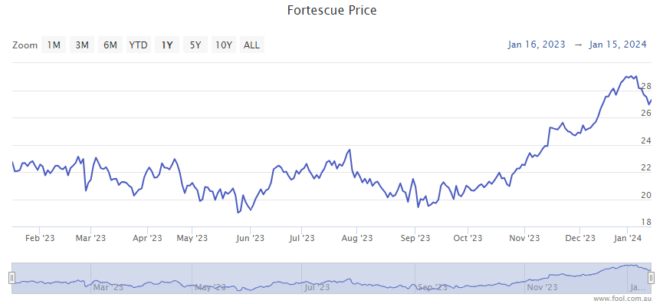

Fortescue Ltd (ASX: FMG)

Fortescue is one of the largest mining shares on the ASX, with a focus on iron ore mining. It is also developing a significant green energy portfolio relating to green hydrogen, green ammonia and high-performance batteries.

The company's shorter-term success is highly linked to what's happening with the iron ore price. If the commodity price goes up, much of that extra revenue can translate into extra net profit because the mining costs don't change much.

The iron ore price has risen noticeably over the last few months. It's currently sitting at US$130 per tonne, unlocking the potential of a bigger Fortescue dividend in FY24 compared to FY23.

If we look at the Commsec forecast for the Fortescue annual dividend per share, it's projected to rise by 8.6% to $1.90. This would be a grossed-up dividend yield of 10%.