'Tis the time of year to review the performance of our stock portfolios, and many Australian investors have ASX ETFs or exchange-traded funds as part of that mix these days.

So, let's take a look at which ETFs investing in Australian shares did best in 2023 based on total returns (that is, share price gains and dividend returns combined).

For the purposes of this article, we're focusing on ETFs that invest in Australian shares only, and with a defined investment strategy. That means we're excluding index-based and sector-based ETFs.

These rankings are based on data just released by the ASX.

The top 5 ASX ETFs for total returns in 2023

There is a clear theme among the best ETFs of last year — environmental, social, and corporate governance (ESG).

According to the data, here are the top five ETFs:

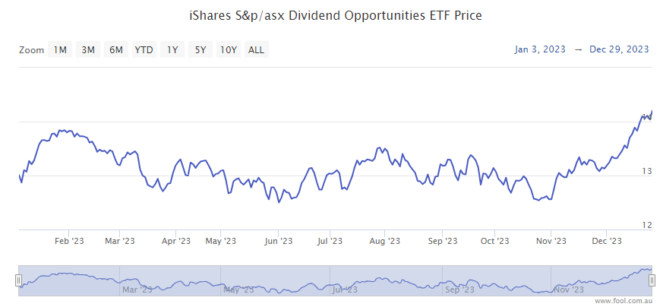

iShares S&P/ASX Dividend Opportunities ESG Screened ETF (ASX: IHD) returned 11.51% in share price growth and distributions over the 12 months of 2023.

iShares Core MSCI Australia ESG Leaders ETF (ASX: IESG) returned 10.73% in 2023.

Vanguard Ethically Conscious Australian Shares ETF (ASX: VETH) returned 9.98% in 2023.

Russell Investments Australian Responsible Investment ETF (ASX: RARI) returned 9.88% in 2023.

VanEck MSCI Australian Sustainable Equity ETF (ASX: GRNV) returned 9.83% in 2023.

EGS shares represent companies with good environmental, social, and governance credentials based on certain criteria.

In this era of climate change and decarbonisation, investors are increasingly seeking to support companies that are doing their bit to save the planet, so ESG stocks are becoming more popular.

More about the No. 1 ETF

According to ETF provider Blackrock, the iShares S&P/ASX Dividend Opportunities ESG Screened ETF invests in up to 50 ASX shares that offer high dividend yields and meet certain sustainability tests.

They also have to meet diversification, profitability and tradability requirements.

The IHD ETF closed at $13.88 per share on Thursday, up 0.58% for the day.

Among the top 10 holdings of the IHD ETF are major miners like BHP Group Ltd (ASX: BHP), big four banks including Commonwealth Bank of Australia (ASX: CBA), Telstra Group Ltd (ASX: TLS), Aurizon Holdings Ltd (ASX: AZJ), JB Hi-Fi Limited (ASX: JBH), and QBE Insurance Group Ltd (ASX: QBE).