The top three S&P/ASX 200 Index (ASX: XJO) bank shares all delivered investors positive returns in 2023.

Two of the big bank stocks performed roughly in line with the ASX 200 and the S&P/ASX 200 Gross Total Return Index (ASX: XJT), which includes all cash dividends reinvested on the ex-dividend date. The third ASX 200 bank share trailed those gains.

In 2023, the ASX 200 gained 9.3%. With the dividends from those income-paying stocks added back in, the Total Return Index gained around 13.9% over the 12 months.

Here's what happened with these leading bank stocks in the year just past.

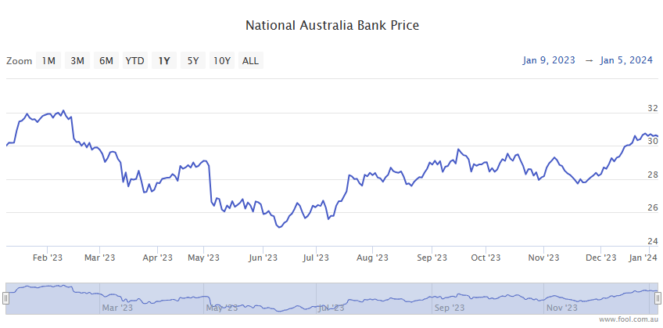

NAB closes the year in the green to come in at number three

The third best-performing ASX 200 bank share in 2023 was National Australia Bank Ltd (ASX: NAB).

NAB shares closed out 2022 trading for $30.06 per share and finished off 2023 trading for $30.70 per share, up 2.1%. If we add in the $1.67 a share in fully franked dividends, the accumulated value of the NAB share price gained 7.7%.

Overall, it was a solid year for the ASX 200 bank share. At its FY 2023 results, NAB reported a 12.9% increase in net operating income to $20.65 billion. Cash earnings increased 8.8% year on year to $7.73 billion.

Still, that came in a bit below expectations, with Goldman Sachs noting this as a "slight earnings miss".

And while NAB's net interest margin (NIM) increased 0.09% in FY 2023 to an average of 1.74%, NAB's NIM fell to 1.71% by September amid stiff competition for new loans and higher deposit cash deposit rates for its customers.

Expenses and credit impairment charges also were up in FY 2023.

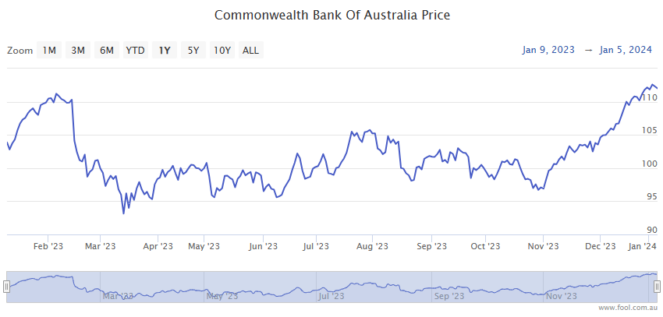

The top two ASX 200 bank shares of 2023

Which brings us to the top two performing ASX 200 bank shares in 2023.

Coming in at number two we have Commonwealth Bank of Australia (ASX: CBA).

Australia's biggest bank closed 2022 trading for $102.60 per share and finished 2023 trading for $111.80 per share, up 9%. Adding in the $4.50 a share in fully franked dividends, and the accumulated value of CBA shares gained 13.4%.

The ASX 200 bank share wasn't immune to NIM compression from ongoing competition for Australia's lucrative mortgage market.

But investors rewarded the bank on some strong FY 2023 results. Those included a cash net profit of $10.2 billion, up 6% from the prior year. And operating income leapt 13% from FY 2022 to $27.3 billion.

The bank reported a 0.46% increase in its common equity tier 1 (CET1) ratio to 11.8%, leaving it in a strong position to handle any unanticipated financial shocks.

As for the best-performing ASX 200 bank share of the year, that title goes to Australia and New Zealand Banking Group Ltd (ASX: ANZ).

ANZ shares closed 2022 trading for $23.66. The big four bank ended 2023 trading for $25.92 a share, up 9.6%. Adding in the $1.75 a share in partly franked dividends, and the accumulated value of ANZ shares gained 17%.

ANZ reported some very strong results for FY 2023. That included a 5% year on year increase in operating income to $20.5 billion. And cash earnings leapt 14% to a record high of $7.4 billion.

Likely attracting the interest of passive income investors, the ASX 200 bank share's FY 2023 dividend was up 20% from the prior year.

And its CET1 ratio increased 1.05% to 13.30%.