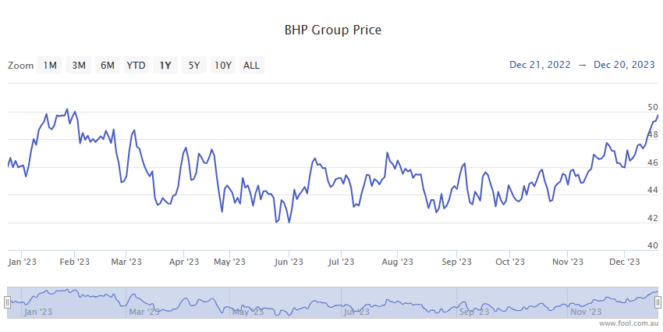

The BHP Group Ltd (ASX: BHP) share price is marching higher on Friday.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed yesterday trading for $49.74. At the time of writing, shares are swapping hands for $49.99, up 0.5%.

For some context, the ASX 200 is up 0.2% at this same time.

Here's what's spurring investor interest.

Why is the BHP share price outpacing the ASX 200 today?

The BHP share price is enjoying tailwinds from several fronts today.

First, the ASX 200 miner is listed on several international exchanges, with the moves in the Aussie market often reflecting the overnight moves of its United States listing.

And BHP's NYSE listed stock closed up 2.7% yesterday, which also saw its shares handily outpacing the 1% gains posted by the S&P 500 (INDEXSP: .INX).

Then there's the ongoing resiliency in global iron ore markets.

Iron ore, as you're likely aware, is the top revenue earner for BHP.

The industrial metal continues to trade well above most analysts' forecasts, with the iron ore price up another 2.6% overnight to trade for US$137.35 per tonne.

It was only back in mid-August that iron ore was selling for US$104 per tonne. The BHP share price has gained 15% since 17 August.

Copper, the second biggest revenue earner for BHP, also ticked higher overnight. Copper is trading for US$8,662 per tonne, up 0.9%.

What else is happening with the ASX 200 miner?

In other news unlikely to have a material impact on the BHP share price today, the company announced that Catherine Raw will replace Johan van Jaarsveld as chief development officer.

Van Jaarsveld will be moving into the position of chief technical officer as part of BHP's executive leadership team shakeup.

With a background in geoscience and fund management, Raw is currently the managing director at SSE Thermal.