Earning an extra $500 every month in passive income from ASX dividend shares would make a sizeable difference for most Australians.

Maybe you'll reach that goal before retiring and be able to tap into that income pool for some extra luxury items or holiday travel.

Or maybe that $500 in monthly passive income, or $6,000 a year, will help you live the life you want to live after hanging up your hat and kicking back to enjoy your golden years.

Fortunately, there are numerous quality ASX dividend shares to consider. And unlike most international exchanges, many ASX shares pay franked dividends, offering potential tax benefits.

So, just how much would you have to invest in ASX shares to earn $500 a month in passive income?

Investing in ASX dividend shares for passive income

How much you'll need to invest will, of course, depend on the yield you receive from your portfolio of ASX dividend shares.

And take note that these yields will tend to vary from year to year.

For a diversified portfolio, you'll want to own a number of ASX income stocks (perhaps 10), operating in various sectors and ideally even a few different nations. That reduces the risk of your passive income getting squeezed if a specific company or sector comes under pressure.

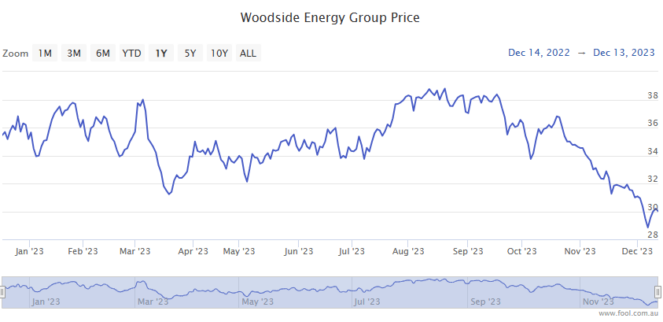

One high-yielding company to consider is S&P/ASX 200 Index (ASX: XJO) energy stock Woodside Energy Group Ltd (ASX: WDS).

Woodside paid out $3.40 per share in fully franked dividends over the past 12 months. At the current Woodside share price, that equates to a trailing yield of 11.2%.

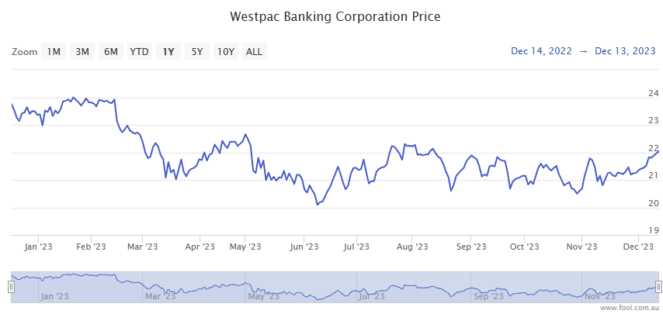

Moving to a different sector to help smooth our passive income stream, we have ASX 200 bank stock Westpac Banking Corp (ASX: WBC).

Westpac delivered $1.42 per share in fully franked dividends over the past 12 months. That equates to a trailing yield of 6.4%.

The average yield for these two stocks then comes out to 8.8%.

For the purposes of this article, we'll leave it with these two ASX 200 dividend stocks. But as mentioned, I'd aim to expand that to a portfolio of around 10 income shares. And I believe that with the proper research, or advice, you could achieve an average annual yield of 8.8%.

To begin earning $500 a month in passive income immediately then, you'd need to invest $68,182 today.

Now that's a sizeable sum to invest all in one go.

But that's okay.

Investing is a long game.

You could always invest smaller amounts, say $1,000 a month, and you'll reach your passive income goal in good time.