BHP Group Ltd (ASX: BHP) shares are joining in the broader market retrace today.

In early afternoon trade on Monday, shares in the S&P/ASX 200 Index (ASX: XJO) mining giant are down 0.2%, trading for $49.30.

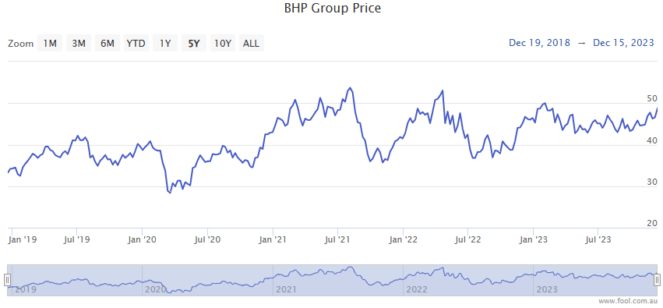

Still, that's well up for the year. And well, well up since the early days of the pandemic.

Which brings us to our headline question.

If I'd put $2,000 in BHP shares at the start of the pandemic, just how much would I have now?

Taking the plunge on BHP shares when fear ruled the markets

The market crash in the wake of the COVID pandemic was like nothing the world had ever seen before.

Most every stock, including BHP shares, was sold off heavily.

And it wasn't just stocks. Commodities took a hit too.

In mid-March 2020, iron ore – BHP's top revenue earner – was down to US$86 per tonne. And copper – the miner's second biggest revenue driver – had fallen to US$4,810 per tonne.

Today iron ore is fetching US$134 per tonne, while copper is trading for US$8,549 per tonne, according to data from Bloomberg.

As for BHP shares, on 13 March 2020, I could have bought them for $26.72 apiece, after they'd plunged some 34% in just six weeks.

If I'd followed Warren Buffett's advice to be greedy when others are fearful (I didn't!), I could have bought 74 shares in the mining giant with my $2,000, with enough change left over for a large pizza.

At the time of writing BHP shares are trading for $49.30 apiece. This means my 74 shares would now be worth $3,648.20. Or a tidy gain of $1,648.20.

But wait. There's more!

Don't forget the dividends!

Atop the potential for capital gains, BHP shares are sought out by passive income investors for their reliable dividend payments.

And despite the pandemic pressures, the ASX 200 miner continued to pay out two annual dividends throughout the crisis.

If I'd bought my BHP stock on 13 March 2020, I would have been eligible for seven fully franked paid-out dividends since that date.

Assuming I opted not to reinvest those dividends, that would have seen me bank an extra $12.03 in income per BHP share, or a total of $899.22 from my 74 shares.

Which means the accumulated value from my initial $2,000 investment in the early days of the pandemic comes to $4,538.42.

It looks like Warren Buffett may be on to something!