EVERYONE loves a bargain. Especially at this time of year when costs are high and the pressure's on to spend big over the holiday season.

But a true bargain is not just cheap: It's a quality item that, for whatever reason, is selling for less than its true value. And many such bargains can be found on the ASX right now.

After a highly volatile 2023, the Aussie share market has seen plenty of quality companies suffer huge share price losses, but their businesses are largely unchanged and still solid.

Want some ideas?

We asked our Motley Fool writers for their thoughts on which cheap ASX shares offer the best-value buying right now. Here is what the team came up with:

5 cheap ASX shares for December 2023 (smallest to largest)

- RPMGlobal Holdings Ltd (ASX: RUL), $365.32 million

- Johns Lyng Group Ltd (ASX: JLG), $1.65 billion

- Santos Ltd (ASX: STO), $23.71 billion

- Telstra Group Ltd (ASX: TLS), $44.37 billion

- CSL Limited (ASX: CSL) $131.57 billion

(Market capitalisations as of market close 13 December 2023).

Why our Foolish writers think these ASX stocks are bargain buys

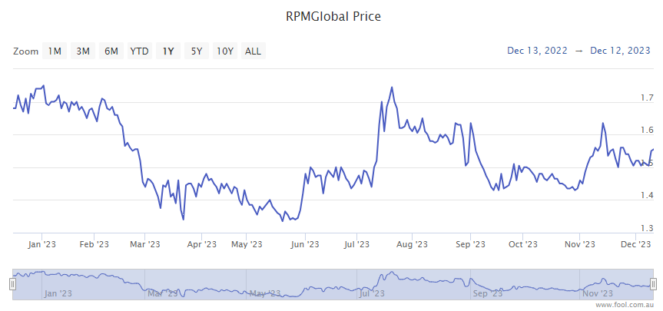

RPMGlobal Holdings Ltd

What it does: RPMGlobal provides technology and consulting services to mining companies. It has been around since the 1960s, but its current incarnation makes the majority of its revenue from software.

By Tony Yoo: Mining is a cyclical – read fickle – industry that has wild ups and downs. Therefore investing in service providers in the resources industry could act as proxy exposure with less volatility.

RPMGlobal fits that bill, but its share price has come about 9% off since its July peak, which presents a buying opportunity before the year is over.

Currently, western economies are straining under the pressure of a rapid rise in interest rates, and China is battling deflation. Many commentators are expecting the global economy to recover from this trough over the next couple of years. And when consumer and business demand picks up, so do commodity prices. When mining companies are booming, so do businesses like RPMGlobal.

Both Moelis Australia and Veritas Securities analysts believe RPMGlobal shares are a buy at the moment.

Motley Fool contributor Tony Yoo does not own shares of RPMGlobal Holdings Ltd.

Johns Lyng Group Ltd

What it does: Johns Lyng is a building services group that provides building and restoration services across Australia, the United States, and recently New Zealand. Its core business is about rebuilding and restoring properties and contents following damage by insured events.

By Tristan Harrison: The Johns Lyng share price has declined by 36% since April 2022, making it a better value as an investment.

The company is growing quickly – FY23 saw net profit after tax (NPAT) go up 41%, and the dividend increased 58%. Johns Lyng expects more growth in FY24.

It's benefiting from both strong core operational growth and more catastrophe work – a trend that could continue as it wins more catastrophe work contracts.

It's expanding in the body corp management space, which opens up an additional, separate earnings avenue, plus there are synergies with the core business.

Plus, the company just acquired Smoke Alarms Australia, a national smoke alarm, electrical and gas compliance, testing and maintenance business. It also acquired Linkfire, a fire and essential safety services business in Victoria and Newcastle. These acquisitions can provide defensive earnings and more synergies.

Motley Fool contributor Tristan Harrison owns shares of Johns Lyng Group Ltd.

Santos Ltd

What it does: With its headquarters in Adelaide, South Australia, Santos is a global oil and gas company with operations spanning Australia, Papua New Guinea, Timor-Leste and the US.

By Bernd Struben: The Santos share price has fallen 9% since 20 October. That's largely due to a retrace in energy prices. Brent crude oil is currently trading for US$76 per barrel, down from US$92 per barrel on 20 October.

With the International Energy Agency forecasting an upswing in global oil demand in 2024 and OPEC+ intent on restricting output at least through Q1 2024, I expect Santos shares will rebound in the months ahead alongside a rising oil price. Goldman Sachs recently reaffirmed its expectations for Brent to trade in the range of US$80 to US$100 next year.

Atop that, there's the exciting potential of a merger with Woodside Energy Group Ltd (ASX: WDS) on the cards. Confirmation that merger talks were ongoing saw the Santos share price close 6% higher last Friday.

Motley Fool contributor Bernd Struben does not own shares of Santos Ltd or Woodside Energy Group Ltd.

Telstra Group Ltd

What it does: Telstra is the largest telco in Australia, offering a myriad of communication services such as fixed-line internet and mobile telephony.

By Sebastian Bowen: When looking for an oversold share, Telstra caught my eye. Investors seem to have lost interest in this telco ever since it announced it was abandoning plans to divest its valuable infrastructure assets earlier this year.

However, the double-digit declines we have seen in the Telstra share price over the back half of 2023 could present a compelling buying opportunity today.

Telstra is a highly defensive share with a strong moat in the form of its superior mobile network. Woes at arch-rival Optus would have done nothing to harm its future prospects, either.

Considering Telstra's fully-franked dividend yield is over 4.4% today, you could do worse than this blue-chip stock.

Motley Fool contributor Sebastian Bowen owns shares of Telstra Group Ltd.

CSL Limited

What it does: CSL is a global biotechnology company that develops and delivers innovative medicines that save lives, protect public health and help people with life-threatening medical conditions.

By James Mickleboro: CSL shares have had an uncharacteristically poor year in 2023. And while they have recently rebounded from their lows, they still remain down 15%.

I believe this is an opportunity for investors to buy one of the highest quality companies that Australia has ever produced at an attractive price.

Especially with Goldman Sachs believing that CSL is "now entering a period of more capital-efficient growth" and forecasting an earnings per share compound annual growth rate of 14% between FY 2023 and FY 2027. This is expected to be underpinned by a margin recovery in its key plasma business.

Goldman has a buy rating and a $309.00 price target on its shares.

Motley Fool contributor James Mickleboro owns shares of CSL Limited.