There are plenty of ASX investors who own units of the BetaShares Nasdaq 100 ETF (ASX: NDQ). This popular exchange-traded fund (ETF) dominates the most popular international shares ETF lists on the ASX. So there'll be quite a few investors that will be happy with today's ASX news.

The BetaShares Nasdaq 100 ETF has just hit a new all-time record high. Yep, NDQ units closed at $37.11 each on the ASX yesterday. But this morning, those same units have lept up by a solid 1.02% at the time of writing to $37.49 each. That's bang on the fund's new all-time high.

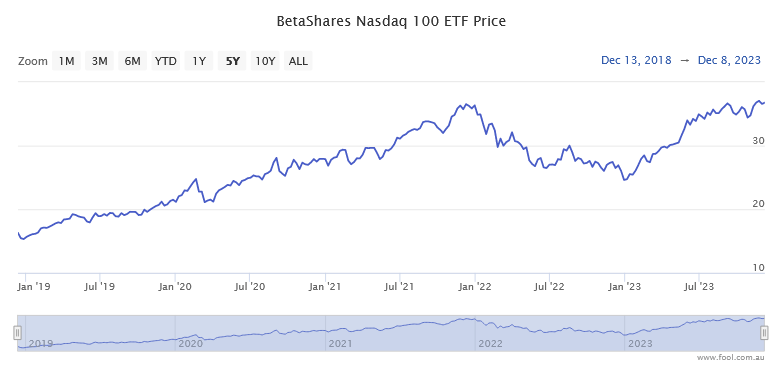

This latest push upwards solidifies the incredible year that this US-based ETF has had in 2023 so far. As it now stands, NDQ units have gained a whopping 51.1% year to date, as well as 42% over the past 12 months.

Over the past five years, investors have enjoyed a stonking return of 132.6%. And that's before dividend returns. Check it out for yourself below:

But when checking out what might have sparked this latest NDQ all-time high, things get a bit interesting.

The Nasdaq 100 Index that this ETF tracks contains most of the largest tech shares on the US markets. That's your Apples and Amazons, Microsofts, Alphabets and Teslas.

Normally, it's a combination of these tech titans that is responsible for any gains that the index, and the ETF, enjoy.

However, last night's US trading saw most of these names sell off meaningfully. To illustrate, Apple stock was down 1.29%. Amazon lost 1.04%, while Alphabet shed 1.26% and Tesla, 1.68%. Microsoft lost 0.78%, and NVIDIA tanked 1.85%.

Not your normal recipe for a new all-time high for an ETF that counts these shares as its most influential members.

So what gives?

Why has the NDQ ETF just seen a new record ASX high?

Well, a couple of other reasons could be responsible.

First, plenty of other major NDQ holdings had great nights last night. Broadcom, another major NDQ stock, had a great night, soaring 9%. As did Adobe, up 2.49%. Costco stock rose 2.14%, while PepsiCo shares were up 1.29%. Netflix was also making investors happy with its rise of 1.35%.

It's possible that these other NDQ constituents saved the day here.

But we also can't discount what has happened with the Australian dollar over the past few days. The Aussie dollar is now around 0.8% lower today than where it was just last Friday. Yep, the end of last week had one Aussie dollar buying nearly 66.2 US cents. But today, that same dollar will only net you roughly 65.7 US cents.

Since ASX's NDQ ETF contains assets that are fundamentally priced in US dollars, any falls in our dollar against the US currency make it inherently more valuable in Australia.

So it's probably a combination of these factors that has given investors of the BetaShares Nasdaq 100 ETF a reason to break out the champagne today.