Woodside Energy Group Ltd (ASX: WDS) shares are in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock closed yesterday trading for $29.53. In late morning trade on Wednesday, shares are changing hands for $29.59 apiece, up 0.2%.

That sees Woodside shares trailing the 0.8% gains posted by the ASX 200 at this same time.

But today's performance is in line with the 0.2% gains posted by the S&P/ASX 200 Energy Index (ASX: XEJ).

Energy stocks are underperforming the benchmark index following another 1.1% overnight decline in the Brent crude oil price, now trading for US$77.20 per barrel, according to data from Bloomberg. Oil prices are dipping as investors cast doubt on the voluntary nature of the recent OPEC+ production cut pledges.

That's the latest market action for you.

Now, here's how Woodside is expanding its presence in Mexico.

What's happening in Mexico?

Woodside shares will gain greater exposure to liquefied natural gas (LNG) produced in Mexico after the company announced it has signed a sales and purchase agreement with Mexico Pacific to purchase 1.3 million tonnes per annum (Mtpa) of LNG for 20 years.

That's equivalent to roughly 18 cargoes per year.

The company highlighted the critical role gas is expected to play in the ongoing global energy transition, saying it expects long-term LNG demand to remain strong.

Woodside CEO Meg O'Neill said:

As we deliver on our strategy, we aim to complement Woodside's produced LNG supply with third parties' volumes, giving us greater scale and portfolio flexibility to serve our customers, while optimising our LNG trading activities.

She noted that Mexico Pacific's Saguaro Energia LNG Project is located on the Pacific coast of Mexico. That could help boost Woodside shares longer-term for its proximity to key Asian markets.

"This agreement with Mexico Pacific delivers a new source of LNG into our trading portfolio, expands our geographic diversification in the Pacific Basin and builds on our presence in Mexico," O'Neill said.

The sales and purchase agreement is subject to Mexico Pacific taking a final investment decision (FID) on the proposed third train at Saguaro Energia.

The FID is expected in the first half of 2024. Commercial operations are targeted to kick off in 2029.

How have Woodside shares been tracking?

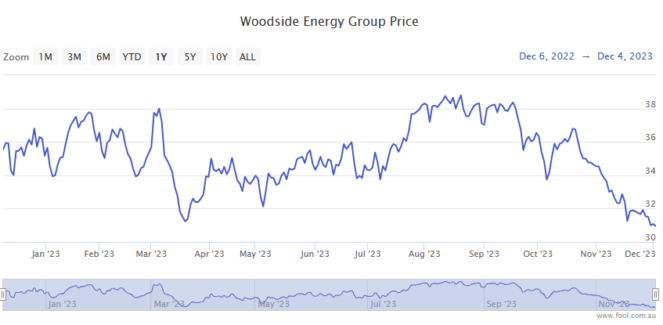

Woodside shares have come under selling pressure amid a large retrace in oil and gas prices since late September.

Year to date the ASX 200 energy stock is down 16%.