The Westpac Banking Corp (ASX: WBC) share price is outpacing the benchmark today.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed yesterday trading for $21.39. In morning trade on Tuesday, shares are swapping hands for $2.40, up 0.1%.

For some context, the ASX 200 is down 0.7% at this same time.

This outperformance comes despite overnight disruptions to the big four bank's online banking services, impacting thousands of Westpac customers.

With Aussie banks increasingly pushing their customers online and away from physical branches, cash payments were not an option for many affected customers.

Here's the latest.

Westpac share price resilient in wake of service disruptions

Customers impacted by the banking outage reported issues like being stranded at the servo after being unable to pay for their petrol. Others complained they couldn't even report the issue to the bank, as they could not log into the required app to make contact.

However, as of early this morning, the service outage was reportedly resolved, likely minimising any negative impact to the Westpac share price.

Westpac reported that the disruptions to its mobile and online banking services were restored around 5am.

The bank said it recognised the outage caused disruptions for its customers and apologised for the incident.

"We know how important it is to have 24/7 access to online banking," Westpac stated.

According to the bank, the online and mobile disruptions were caused by a routine technology update around 9pm last night. This meant customers were unable to view or access their Westpac accounts online.

Management noted that Westpac's technicians had identified the problem "and worked through the night to fix it".

The bank added that payments via cards and digital wallets, scheduled payments and ATMs were not affected by the outage.

Customers with specific concerns resulting from the online service disruption were encouraged to contact the bank for assistance.

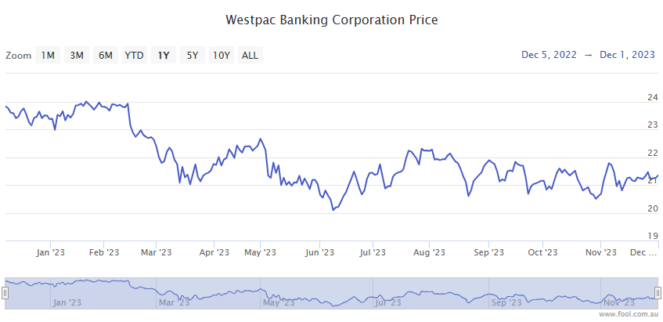

The Westpac share price is down 6% year to date.