The ASX uranium share Nexgen Energy (ASX: NXG) could have a very exciting future, according to a fund manager.

Investment managers were asked to pick out their favourite investment ideas for the year ahead at the annual Sohn Hearts & Minds conference in Sydney recently.

Fund manager Jeremy Bond at Terra Capital told the conference that Nextgen Energy could become "one of the world's top 10 mining stocks", according to the Australian Financial Review.

What is Nexgen aiming to do?

Nexgen describes itself as a British Columbia corporation focused on developing into production the 100%-owned Rook I Project, located in Saskatchewan.

The company says it has a highly experienced team of uranium industry professionals with a successful track record in discovering uranium deposits and developing projects from discovery to production.

The Rook I project is the location of the company's Arrow deposit discovery of February 2014. It has measured and indicated mineral resources totalling 3.75 million tonnes, grading 3.10% U3O8 containing 257 million pounds U3O8.

The company also owns 49.7% of the outstanding shares of IsoEnergy.

In terms of progress, Nexgen recently advised that, in the third quarter of 2023, it further advanced the front-end engineering and design for the Rook I project. The company also continued to progress the project through the critical path of detailed engineering and procurement phases.

Why uranium?

The long-term global effort toward decarbonisation to reduce reliance on energy sources like coal, gas and petroleum could be helpful for the ASX uranium share.

Nexgen points out that climate change, energy security and energy affordability are fundamental demand factors, leading to a "significant increase in demand and new investments in nuclear energy".

According to Nexgen, an approximate 16% increase in nuclear plant capacity is projected this decade, with a double of nuclear capacity expected by 2050.

The ASX uranium share said there was "underinvestment in exploration and mine development" from 2014 to 2020, while strategic reserves and mines have been depleted.

Uranium producers are fully contracted for at least four years, limiting access to supply. Nexgen points to analysis that shows uranium supply will need to triple by 2050 to meet the growing demand.

As Microsoft co-founder Bill Gates once said:

Nuclear is ideal for dealing with climate change, because it is already the only carbon-free, scalable energy source that's available 24 hours a day.

Specifically on Nexgen's place in this story, the company says it has the largest single-source deposit of high-grade, low-cost uranium in the world.

The ASX uranium share said:

The world is embracing nuclear energy as the linchpin to a carbon-free future. At the same time, geopolitical tensions are increasing pressure on the limited uranium supply necessary to make this future a reality.

The Rook I Project is essential to meeting the growing demand for uranium and delivering clean and secure energy solutions.

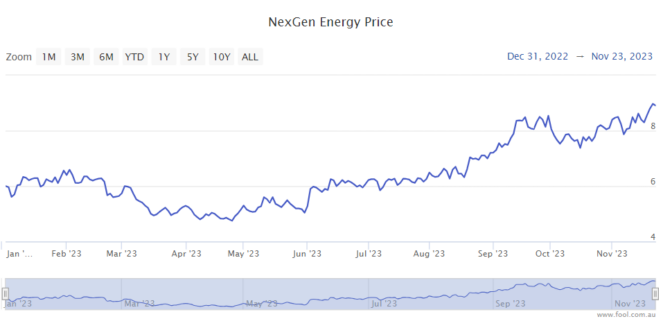

Nexgen share price snapshot

Since the start of 2023, the Nexgen share price has lifted by more than 50%, as we can see on the chart below.