I think it's a great time to invest in quality cheap ASX shares while we're being offered such good prices by the market.

The only time when share prices become particularly attractive is when there's something to be genuinely concerned about, nationally or globally. High interest rates are certainly causing investors to be cautious.

I think it's periods like this that can set the foundations for strong returns. Yes, there may be further volatility in the next 12 months. But I believe in three to five years, investors could make solid returns.

In my opinion, it's sold-off areas like ASX retail shares and ASX healthcare shares where there could be opportunities.

I've written about where I have been investing. But I also believe the below stocks look like quality cheap ASX shares.

Volpara Health Technologies Ltd (ASX: VHT)

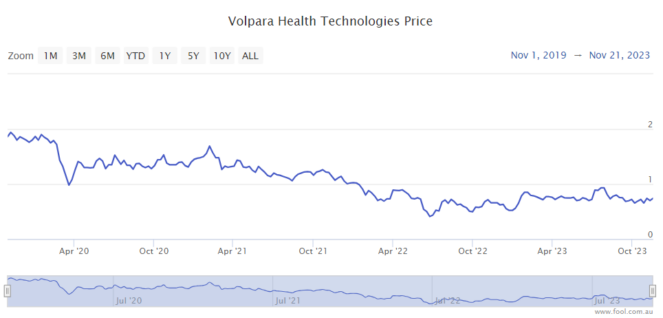

Despite the company's rapidly improving bottom line, Volpara is still down 30% from mid-July 2023 and it has fallen 65% from November 2019.

The FY24 first-half result showed a number of positives – annual recurring revenue (ARR) rose 18% year over year to US$22.5 million, the gross profit margin remained very high at 91.6%, and the underlying earnings before interest, tax, depreciation, and amortisation (EBITDA) rose 68% year over year to a loss of $1.4 million. Operating expenses fell 4%.

Its HY24 net revenue retention was 112%, meaning it's getting more revenue from the same customers. Net operating cash flow improved 121% to a net inflow of NZ$1.3 million, compared to a net outflow of NZ$6 million in HY23.

It's expecting more revenue growth and to remain cash flow positive from here onwards. I think it could do very well over the next five years.

Adairs Ltd (ASX: ADH)

The Adairs share price has fallen around 50% since the start of February 2023, as we can see on the chart below.

Adairs sells homewares and furniture through its own brand name, as well as Mocka and Focus on Furniture. I fully expect that retail sales are going to suffer in the next 12 months as the pain of interest rates and a higher cost of living bite further into household finances.

I'd hold off buying before the AGM (on 24 November 2023) just in case there's a nasty surprise. But, after that, I think it's possible the Adairs share price could see a good recovery in three years (or less) once retail conditions normalise.

Australia's rapidly growing population could provide a useful boost in demand in future years. The company also has a number of initiatives to grow its revenue and profit in the future, such as an expansion of its floor retail space, more (paid) members, and the planned efficiencies of its new national distribution centre.

Is this a cheap ASX share? Forecasts are not guaranteed, but the Adairs share price is currently valued at under seven times FY25's estimated earnings, based on Commsec projections.

Premier Investments Limited (ASX: PMV)

Premier Investments is a retailer that owns a number of different brands including Peter Alexander, Smiggle, Just Jeans, Jay Jays, Dotti, and so on. It also has substantial investments in Breville Group Ltd (ASX: BRG) and Myer Holdings Ltd (ASX: MYR).

As we can see on the chart below, the Premier Investments share price is down 25% from November 2021.

I think the international growth plans of Smiggle and Peter Alexander are very compelling, particularly with the world now on a better path after the end of widespread COVID-19 impacts, such as schools being open.

The long-term growth of its digital sales is appealing because it comes with stronger margins.

I also like the look of the forward price/earnings (P/E) ratio. According to the projections on Commsec, the Premier Investments share price is valued at 15 times FY24's estimated earnings, which includes a forecast of lower profit.