Lynas Rare Earths Ltd (ASX: LYC) CEO Amanda Lacaze has sold one million Lynas shares, netting herself approximately $7,041,000 in the process.

A notice lodged with the ASX reveals Lacaze sold the million shares in three tranches over Monday, Tuesday, and Wednesday of last week via a family trust.

She sold 200,000 Lynas shares at $6.983054; 300,000 at $7.001992; and half a million shares at $7.088954.

At the same time, Lacaze chose to exercise 430,163 employee performance rights. This means she also acquired 430,163 Lynas shares, also through her family trust.

The notice also states that 208,856 employee performance rights had lapsed due to performance conditions not being met.

The reason given for the on-market selldown of the one million Lynas shares was to meet taxation liabilities. This is a very common reason given by senior company managers for large share sales.

Lynas shares closed down 1.02% on Wednesday at $6.80 apiece.

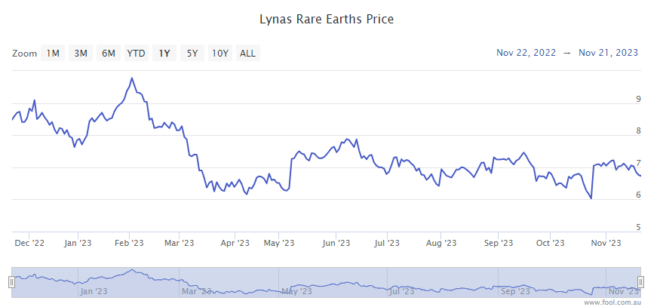

The ASX rare earths share has had a tumultuous 12 months, as the following chart shows.

Lynas shares have ranged in value from a high of $9.85 in February to a low of $6.02. They hit that low on two separate occasions in April and October.

What's the latest news about Lynas shares?

Lynas shares rebounded strongly off their October 52-week low after the company announced it had been granted its request for a variation to its Malaysian operating licence.

In fact, the Lynas share price surged by more than 17% on the news over the next two days. This prompted an official ASX price enquiry.

The licence has been a drama for Lynas for most of the year.

Lynas asked for the variation because the Malaysian government has decided to prohibit the importing and processing of lanthanide concentrate due to worries about radioactive waste.

Without a variation, Lynas would have had to close its cracking and leaching plant in Malaysia.

Big problem.

The variation allows for the continued importation and processing of lanthanide concentrate from the Mt Weld mine in Western Australia at the Lynas Malaysia facility. The licence is valid until March 2026.

As part of the deal, Lynas Malaysia will increase its research and development investment in Malaysia from 0.5% to 1% of Lynas Malaysia's gross sales. The R&D program will focus on environmental advancements and will be overseen by the Malaysian Atomic Energy Licensing Board (AELB).