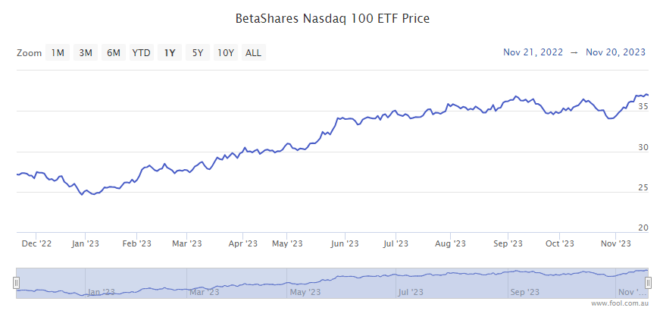

The Betashares Nasdaq 100 ETF (ASX: NDQ) share price has skyrocketed in 2023, up 49% to $37.03.

This compares to a meagre gain of 1.75% for the S&P/ASX 200 Index (ASX: XJO) and a moderate-by-comparison 24% lift in the S&P/ASX All Technology Index (ASX: XTX).

The ASX NDQ has also bested the performance of the broader NASDAQ Composite Index (NASDAQ: .IXIC), which is up 37.5% in the year to date.

The likely reason for this is that the exchange-traded fund (ETF) tracks only the NASDAQ's top 100 shares. That means ASX NDQ investors are exposed to the cream of the crop.

The top 10 holdings of the ASX NDQ are:

- Apple (11.1% weighting)

- Microsoft (10.4%)

- Amazon (5.6%)

- Nvidia (4.6%)

- Meta Platforms (3.9%)

- Broadcom (3.3%)

- Alphabet (Class A and C shares both 3%)

- Tesla (2.8%)

- Adobe (2.2%).

What are the themes driving ASX NDT growth?

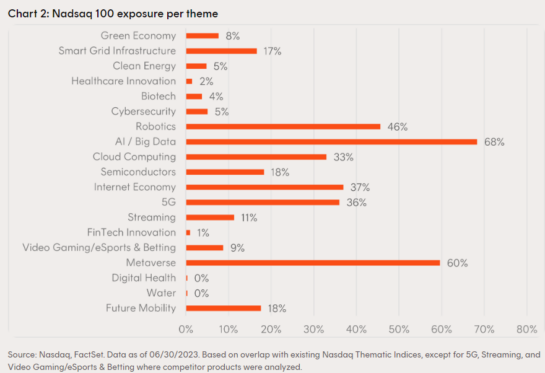

In a recent article, BetaShares investment strategist Tom Wickenden revealed the strongest technology thematics now driving the ASX NDT ETF.

As you can see below, they are artificial intelligence (AI)/big data 68%, the Metaverse 60%, robotics 46%, the internet economy 37%, 5G 36%, and cloud computing 33%.

Source: BetaShares

A 'headstart' on the AI thematic, says expert

There has been increasing interest in AI shares of late, and Wickenden points out that the ASX NDQ provides great direct exposure to AI and a large number of other popular IT thematics.

Wickenden says:

More recently as markets shift their focus to machine learning and artificial intelligence (AI), the Nasdaq 100 again has a head start.

With the ability to leverage their existing competitive advantages, companies listed on the Nasdaq like Microsoft (whose partnership with ChatGPT provider OpenAI started in 2016), Google (who acquired AI startup DeepMind in 2014), and Nvidia (who started laying the foundations to become the engine room for AI hardware in 2006) have already been investing in AI for a long time with the aim of becoming leaders in the area.

Breaking down the index into its constituent's exposure to areas of future growth potential, we find that the Nasdaq 100 provides exposure across a broad subset of potentially promising investment themes.

ASX NDT share price snapshot

Wickenden says that over the 20 years to October 2023, the NASDAQ-100 Index (NASDAQ: NDX) has returned 13% per annum (p.a.). This compares to 8% p.a. for the S&P 500 Index (SP: .INX) and 6% p.a. for the ASX 200.

Source: BetaShares

The inception date for the ASX NDQ was 26 Ma, 2015, so 20 years of data is not available.

However, BetaShares reports that the ETF has returned 18.07% after fees since inception. This compares to the NASDAQ 100 index at 18.45% over the same period.

The Betashares Nasdaq 100 ETF is Betashares' largest ETF, with more than $3 billion in funds under management. There is also a currency hedged option under ASX ticker HNDQ.