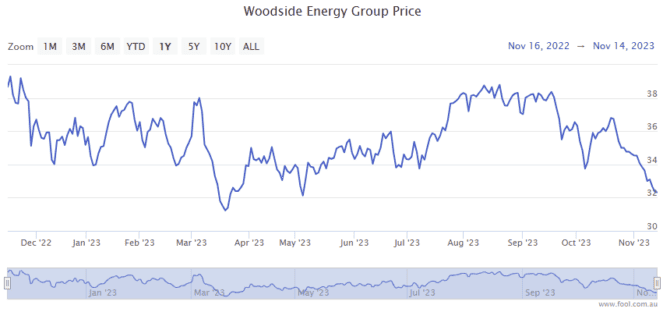

The Woodside Energy Group Ltd (ASX: WDS) share price closed 1.0% lower on Thursday.

Shares in the S&P/ASX 200 Index (ASX: XJO) oil and gas stock finished the day trading for $32.08 apiece.

That came amid a dip in the oil price, with Brent crude oil slipping to US$80.48 per barrel.

For some context, the ASX 200 also ended the day in the red, down 0.67%.

That's the recent price action for you.

Now, can the Woodside share price leap 14% in time for Christmas?

14% upside for the Woodside share price?

There are a number of reasons I'm optimistic on the outlook for the ASX 200 energy stock.

Atop its existing portfolio of operational high-quality, low-cost oil and gas assets, the Woodside share price is likely to enjoy long-term support from the company's three major growth projects.

Namely, Sangomar, located in Senegal; Scarborough, located in Australia; and Trion, located in Mexico. While Woodside is still working on the final environmental approvals for the Scarborough project, management is targeting the offshore project's first LNG cargo in 2026.

"The combination of the strong base business and these new investments will generate strong future cash flows and returns for our shareholders across the price cycle," Woodside CEO Meg O'Neill said last week.

As for the 14% boost in the Woodside share price, Goldman Sachs has a buy rating on the stock with a $36.60 price target. That's 14% above yesterday's closing price.

Now to be clear, this is a 12-month price target. So even if Goldman's analysts have this right, Woodside shares might not get there by Christmas.

Goldman Sachs likes the ASX 200 energy stock for its "attractive valuation discount", with its analysts noting Woodside trades "at a 14% discount to NAV after recent oil price weakness".

Goldman also cites oil production and earnings growth, with "4% production growth over the next 12 months" expected.

All I want for Christmas…

Now, in my opinion, the biggest single factor that could help send the Woodside share price up 14% by Christmas would be a significant uptick in oil and gas prices.

The oil price has come down 13% since 19 October, resulting in an almost equal slide in the ASX 200 energy stock.

But with both OPEC+ and the International Energy Agency (IEA) now forecasting an increase in oil demand in 2024, a rebound in crude prices back to mid-October price levels is quite possible before Santa comes knocking.

According to the IEA, "global oil demand is set to rise to a record annual high of 102.9 million barrels per day (mb/d) in 2024".

As for the more immediate outlook for oil, and by connection the Woodside share price, the IEA said that global oil demand was "still exceeding available supplies heading into the Northern Hemisphere winter".