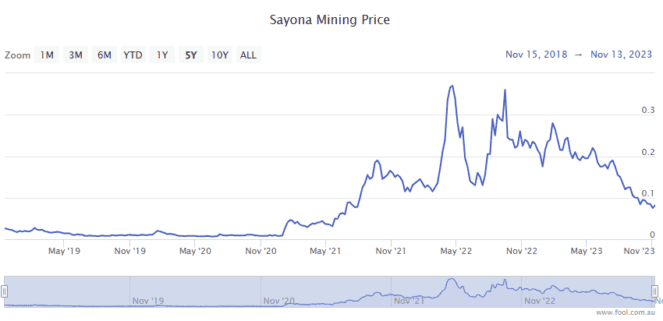

Sayona Mining Ltd (ASX: SYA) shares have seen their fair share of ups and downs over the past three years.

Well, more than their fair share really, as you can see on the price chart below.

Sayona Mining shares got a huge boost from mid-2021 into late 2022 amid a rapid spike in lithium prices.

The S&P/ASX 200 Index (ASX: XJO) lithium share has projects in Canada and Australia.

In recent years, its focus (and investor attention) has primarily been on its joint venture North American Lithium (NAL) project. Sayona Mining owns 75% of NAL, while Piedmont Lithium Inc (ASX: PLL) holds the other 25%.

Like many ASX lithium stocks, Sayona Mining has taken a beating in 2023 amid big falls in lithium prices. Yet, despite a 58% year-to-date share price fall, investors who bought three years ago will still be sitting on sizeable gains.

How sizeable?

Let's do the maths.

How have Sayona Mining shares performed over three years?

Three years ago, on 13 November, I could have picked up Sayona Mining shares for 1 cent apiece. Meaning I could have bought 400,000 shares with my $4,000 investment.

I would have then watched those shares rise and fall (and rise and fall), all the way to a peak of 36 cents per share on 22 April last year. While that would have been an opportune time to sell, lacking a crystal ball, I would have held onto my shares. At least for the purposes of this scenario.

Amid ongoing volatility, the ASX lithium stock broadly headed lower since April 2022.

Fast forward to the present time, and yesterday saw the stock close up 2.6% to 8 cents per share. Or a 700% gain over the three years.

A little back-of-the-napkin maths tells me that my 400,000 Sayona Mining shares would now be worth a cool $32,000.